About Nexo

Nexo is an entire crypto finance ecosystem allowing you to earn interest on cryptocurrencies, borrow against your crypto as well as the having the regular buy, sell trade features of a regular exchange. Since being founded in 2018, Nexo has seen huge growth in its platform. According to Nexo, they now have over 4 million users worldwide.

This in depth Nexo review will focus on the features available to Australian users. Read on to find out more.

Quick Summary

- Website: nexo.io/

- Headquartered: Zug, Switzerland

- Trading fees:

- Listed cryptocurrencies: 40+

- AUD Deposit and withdrawal fees: Free

- Deposit limit: NA

- Fiat currencies: USD, GBP & more

- Deposit Methods: Bank transfer & more

- Australian-based customer service: No

Pros

- Instant cash loans while holding crypto

- Earn up to 12% interest on coins and fiat currencies through high yield interest account

- Easy to use mobile app

- Insured against theft for $300+ million

- Quick and easy loan review process

Cons

- Limited Trading Capacity

- Slow customer service

- Lacks education resources for how to use the platform

Our honest thoughts on Nexo

In our opinion Nexo is the best crypto lending platform for users looking to get instant crypto backed loans and for earning interest on a range if crypto holdings. These are 3 reasons why:

Ease of use:

We found navigating the platform very easy, even for beginners. The verification process was seamless, and only took 5-10 minutes to complete. The app has a clean interface, making for a great user experience.

Interest earning:

One of the biggest benefits of the Nexo wallet app is the interest earning capabilities. Nexo features a high yield cryptocurrency interest account allowing users to earn up to 12% on cryptocurrencies they hold, including stablecoins. This is a great way to earn passive income on cryptocurrency assets that would otherwise just be sitting in your crypto account.

Crypto backed loans:

Nexo offers crypto backed loans, meaning you can take out a loan and use your crypto holdings as collateral. These are known as Nexo instant crypto credit lines. You can use the BTC, ETH, DAI and USDC as collateral. If you default on your loan, however, your cryptocurrency that you used as collateral will be used to pay back your loan.

Downsides:

We identified a couple of downsides to the Nexo platform. Firstly, the fees can reportedly vary. Despite Nexo marketing 0% fees, users have reported that they have incurred fees up to 2%. We feel the platforms need to be more transparent around this issue.

We also found that when reviewing the instant crypto credit line feature, there wasn’t many educational resources or content on the website explaining this process. This can leave users confused, especially because instant crypto-backed loans are such a new concept

| Exchange Website | Cryptocurrencies | Fees | Supported | Visit Website |

|---|---|---|---|---|

| 351 | 1.0% | AUD | Join Coinspot | |

| 330+ | 0.6% | AUD, USD & NZD | Join Swyftx | |

|

250+ | Varies | AUD, USD, GBP & more | Join Crypto.com |

|

280+ | 0.5% | AUD | Join Digital Surge |

| 400+ | 0.1% | AUD, USD, NZD & GBP | Join Binance | |

| 140+ | Varies | USD, NZD & GBP | Join Coinbase | |

| 50+ | Varies | AUD & GBP | Join Coinjar Exchange | |

|

40+ | 0 | USD, GBP & more | Join Nexo |

What is Nexo and how does it work?

Nexo is a crypto platform and savings account provider offering crypto interest accounts and instant crypto-backed loans. It also allows users to purchase a range of cryptocurrencies via both an easy to navigate web platform and app, available on both Android and iOS. The platform itself has some handy features for the everyday crypto investor, offering simple portfolio tracking including routine price updates on all listed assets and a feed of crypto market news.

In just 4 years, Nexo has grown rapidly. It currently has over 3 million users in over 200 countries worldwide. With strategic partnerships in place to continue maintaining high standards of asset security, compliance and user experience, NEXO now offers a leading credit line service giving users the ability to leverage their digital assets and earn interest on their crypto holdings (including stablecoins).

Is Nexo safe?

Nexo is a ISO/IEC 27001certified platform. This is an internationally recognised standard for online security. Nexo deploys industry leading security technologies and practices to reduce the risk of breaches and guards funds on the platform.

In addition to Two-Factor Authentication (2FA), Nexo deploys 24/7 fraud monitoring services to provide a premium level of safety for its users. The app has biometric authentication meaning you can sign in using facial recognition from your mobile phone and to ensure that only you can access your account should your phone be lost or stolen.

Nexo is extremely transparent. According to their Linkedin page, their company has over 260 employees and they continue to work with industry specialists in custody and compliance to ensure they’re programs are compliant with local and national standards.

Lastly, Nexo is insured for $375 million for all clients to cover the cost of losts funds. More on this below.

Is Nexo insured?

Asset safety and security has been a big priority for Nexo. Nexo provides a $375 million USD insurance policy to cover the costs should customers’ funds be stolen. This may seem like a lot but it is not enough to not cover the claimed US$12 billion assets under management. We have provided a breakdown of this insurance policy below:

BitGo wallets

The Nexo in-app wallets are provided by third party wallet provider, BitGo, a leader in digital asset financial services. BitGo itself carries $100 million USD insurance protection.

This insurance comes at no additional cost for customers and covers all cryptocurrencies listed on the Nexo wallet platform in the event of

- Third-party hacks, copying, or theft of private keys;

- Insider theft or dishonest acts by BitGo employees or executives; and/or

- Loss of private keys.

Through BitGo, NEXO provides 100% cold storage technology in bank-grade Class III vaults. Cold storage refers to stroign cryptocurrency offline and is often considered to be the most secure form of digital asset storage.

Ledger

Nexo partners with Ledger, one of the most reputable crypto storage companies in the world. Nexo employs Ledger Vault’s solution program which insures all stored cryptocurrencies for up to $150 million through a customised insurance program.

NEXO is continually looking for new ways to increase their platform security and insurance offering with a strategic goal to increase their insurance coverage to $1 Billion. Even still, this would not cover the total claimed assets under management on the platform ($12 billion USD).

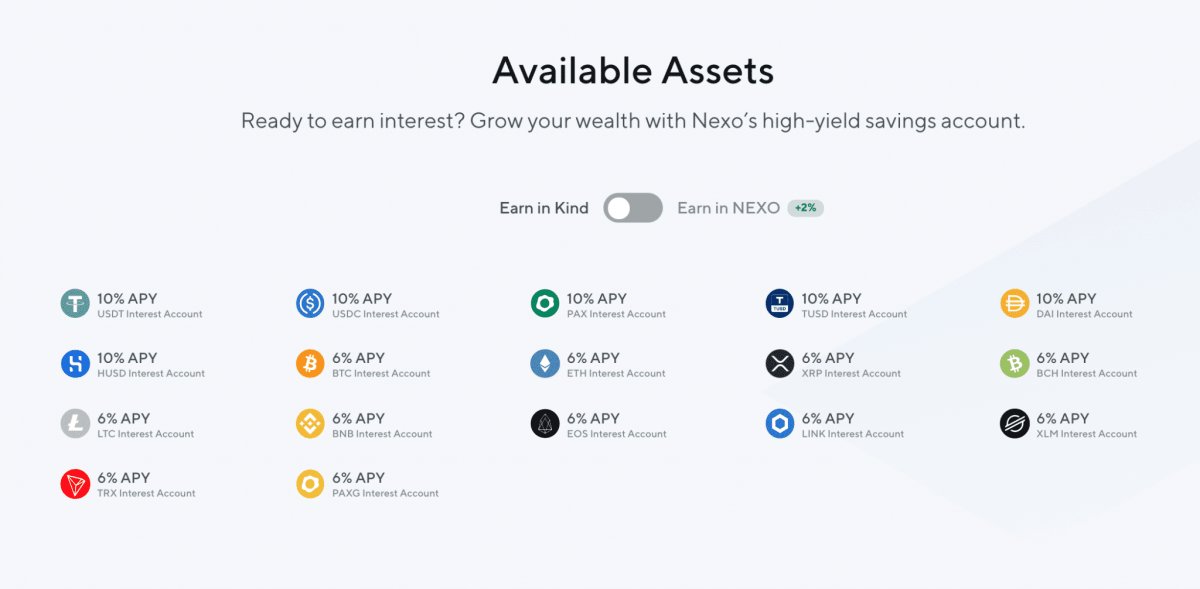

Earn interest on crypto

One of Nexo’s most popular features is it’s interest earning account. Nexo allows you to earn interest on all the cryptocurrencies that it lists on its platform, with higher interest rates commonly offered on stable coins. This includes coins like Bitcoin (BTC), Chainlink (LINK), Ethereum (ETH), Tether (USDT), XRP, Dogecoin (DOGE), Cardano (ADA) and more.

You can earn between 6% and 12% Annual Percentage Yield (APY) on all the assets listed on the platform.

Holders of the native NEXO token are entitled to additional features and benefits. For instance, users can earn more interest on the crypto assets they hold if they own NEXO. The increase in interest will depend on how much the user holds. These interest rate increases can range between 1% and 5%.

Additionally, users can also elect to have their interest earnings paid out in the NEXO. This allows the user to earn an additional 2% in interest.

Interest is earned each and every day, rather than monthly, meaning you can take full advantage of compounding interest.

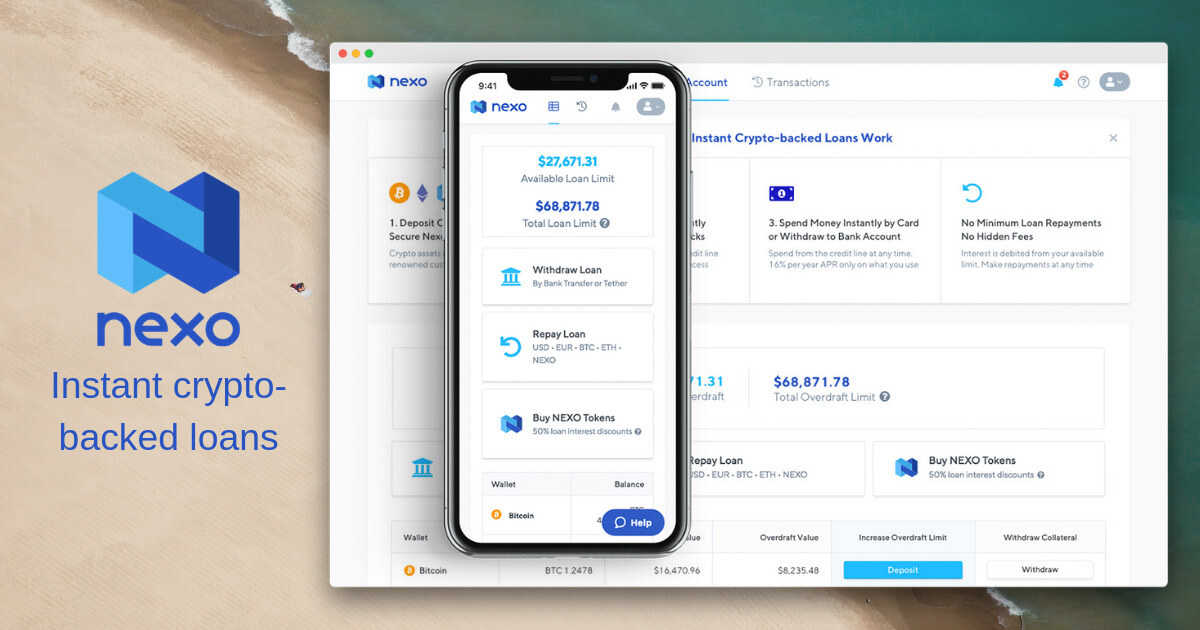

Instant crypto loans: Borrowing from Nexo

One of the Nexo’s biggest draw cards is it’s crypto backed instant loans. This refers to getting a loan whilst using cryptocurrency as collateral. These are referred to as Nexo crypto credit lines. There are several options for collateral including BTC, ETH, DAI, and USDC.

Nexo also does not run credit checks on users who are applying for a loan. Users can choose from 40+ fiat currencies to receive their loan in. Unfortunately, this does not include Australian dollars (AUD). Alternatively, users can choose to borrow stablecoins like USDT or USDC.

The annual percentage rate (APR) on these loans (i.e. the interest paid on top of the loan) will depend on the amount of Nexo tokens the users holds. If you don’t hold any Nexo tokens, the APR will start at 13.9%. If you hold at least 10% of your portfolio in Nexo tokens, you can reduce your APR to 5.9%. It’s important to note that loan repayments will always be rounded to the nearest 30-days, meaning if you repay your loan within a 30-day period, you will still be charged interest for the entire 30-days.

The amount of crypto that you put up as collateral, will have a big influence on the amount you are allowed to borrow.

The minimum you are allowed to borrow is $3 USD and the maximum is $2 million USD.

How to get a loan with Nexo

Below we have provided detailed steps on how to get a crypto-backed loan with Nexo.

Step 1: Sign up for a Nexo account

Firstly, you’ll need to sign up for a Nexo account by providing a few personal details like your email address, mobile number and creating a secure password.

Step 2: Verify ID

Verify your account by providing a copy of your passport or driver’s licence. This process typically only takes 5-10 minutes to complete.

Step 3: Deposit or buy crypto

You can deposit crypto into your Nexo account from another exchange or wallet or you could purchase crypto directly from the Nexo wallet app. The more you crypto deposit or buy, the more credit you can borrow.

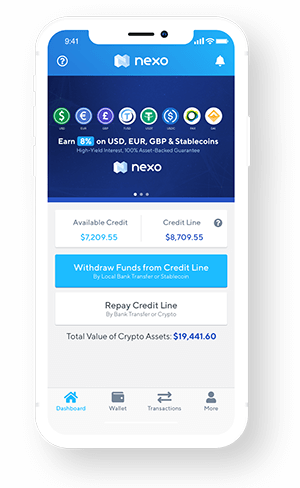

Step 4: Withdraw funds from credit line

On the platform or mobile app, go to ‘Withdrawal Funds From Credit Line where you will see the loan amount available for you to borrow.

Step 5: Choose method and enter bank account details

Choose how you would like to receive funds out of the following options:

- Bank transfer (fiat money)

- USD coin (USDC)

- USD Tether (USDT)

If you choose bank transfer, enter your bank account details and your chosen fiat currency (i.e. Australian dollars) so Nexo can transfer you your funds.

Note: Nexo does not conduct credit checks

Step 5: Get your loan

Get your funds in your account. This may take a couple of days as bank transfers are processed only by Nexo’s banking partners on business days.

How to repay your Nexo credit line

Nexo allows you to repay your loan with a number of different cryptocurrencies. When in the Nexo platform or app, click on ‘Flexible Credit Line Repayment’ which will give you all your available repayment methods. This will simply show all the coins you have available in your savings and credit wallets.

If you do not have enough crypto in your account, you can simply deposit more from an external exchange or wallet, or you could buy more through the Nexo platform.

Unlike most traditional lenders, Nexo does not set a minimum interest payments, meaning you could keep your credit line open for years. Just as long as you have enough collateral to secure your outstanding loan.

Fees and spreads

Nexo does not charge fees on trades. They do, however, charge a spread for trades on the platform. The spread is the difference between the buy and sell price of a crypto asset listed on the platform. According to Nexo, they charge a maximum spread of 0.75% on crypto trades, however, we’ve seen that most spreads are around 0.2%.

Nexo does not charge any sort of maintenance fee for storing your crypto on the platform and you’re also free to withdraw your crypto at any stage without incurring any charges. Nexo does not charge any activation fee for taking out a loan, but like most loan products, they do charge an interest which is repayable on top of the loan amount.

Nexo features and benefits

The Nexo wallet platform has two primary functions: interest earning and crypto-backed loans. However, there are a number of other features and benefits that you should know about before signing up. We have covered these in detail below.

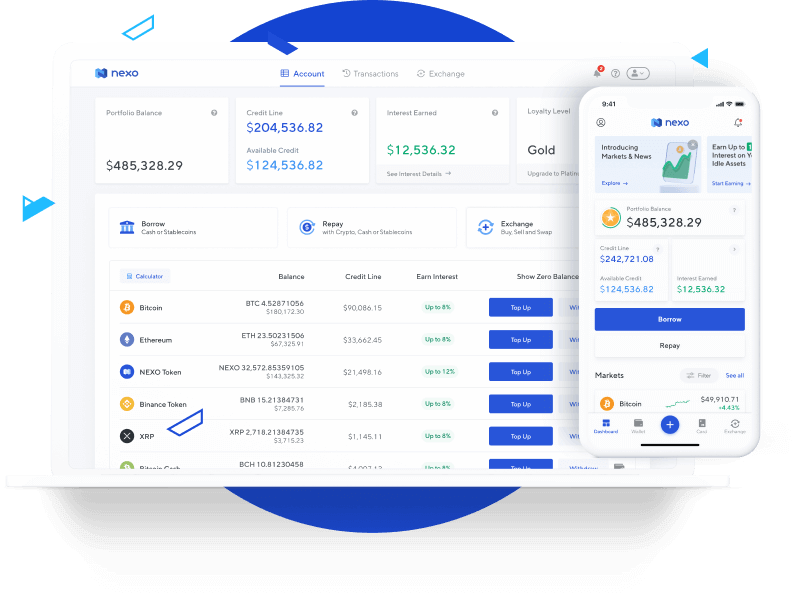

Platform dashboard and interface

Nexo has an easy to navigate platform with a well designed and simplistic user interface.

The platform features well-placed prompts to aid the customers on navigating it without overcomplicating things.

Some Crypto platforms are difficult to navigate and have poor assistance for customers, making them a nightmare for beginners. With Nexo, users can simply open the app, and navigate to their wallet to check balances, select notifications to see information on daily interest rewards and scroll through the dashboard for the latest crypto news and market updates.

Listed cryptocurrencies

Compared to other competitors, Nexo doesn’t offer an extensive list of assets. Currently, Australian users can buy, sell, deposit, withdraw and earn interest on 30+ cryptocurrencies within the Nexo platform. This includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Stellar Lumens (XLM)

- Tron (TRX)

- Tether (USDT)

- USD Coin (USDC)

- XRP

- More

Major Australian crypto exchanges like Binance, Swyftx and Digital Surge list 300+ cryptocurrencies for their users to buy, sell and trade. Nexo’s primary function is not to facilitate crypto trading, rather it allows users to earn interest on crypto holdings and to take out loans using crypto as collateral. Therefore we don’t consider Nexo’s lack of listed crypto assets to be a major downside.

Find out more about these exchanges in our best Australian crypto exchanges guide.

Customer support

Nexo offers the types of customer support. You can get in contact or submit your query via on of the following avenues:

- Live chat

- Online messaging

Their customer support has received mixed reviews online with the main complaint being the amount of time customers have to wait to receive a response from a representative. Fortunately, Nexo has a help centre where users can find information on how to use the platform.

Supported fiat currencies

Nexo supports 40+ fiat currencies on their platform. You can deposit funds via bank transfer and then purchase any of the listed cryptocurrencies on the platform.

Nexo also allows you to take out a loan in any of the 40+ fiat currencies supported by the platform and then receive the funds within a business day by bank transfer to your nominated account. For example, Nexo customers from the UK can elect to take a loan in GBP and nominate an Australian bank account for the funds to be sent to.

In addition to instant loans in 40+ Fiat currencies, customers can also borrow instantly using a US dollar stablecoin such as USDT or USDC, which they can then withdraw from the platform or exchange for a preferred cryptocurrency.

Unfortunately Nexo does not currently offer users the ability to deposit and trade using AUD, however, are looking to expand further into the Australian market and meet further stringent local compliance standards.

Nexo credit card

Nexo features its own crypto Mastercard which is accepted at all Mastercard outlets (currently over 40 million worldwide). Users can get up to 2% cash back rewards on all purchases using this Nexo card.

Unlike Other crypto platforms that feature it’s own card, you will not have to stake the native token of the platform (NEXO) for extended durations of time to receive these rewards. This card is currently only available to Nexo users who are borrowing fiat currency (i.e. USD) using their cryptocurrency as collateral.

How it works:

After a user swipes their card, an oracle confirms the user has enough collateral to cover the purchase. This instantaneously creates a loan on behalf of the Nexo user and executes the transaction.

Users can get one of these cards regardless of their credit history, as the crypto collateral reduces default risk. Likewise, Nexo interest rates are set between 8% and 24% and can vary depending on the structure of the loan and also the loyalty tier of the user. Users can repay their loans in either crypto or their chosen fiat currency. Using the NEXO token for your credit card repayments will reduce interest rates to 8%.

The NEXO token

The NEXO token is the native token of the Nexo platform. This is cryptocurrency that can fluctuate in value just like other exchange tokens including Binance coin (BNB), Crypto.com coin (CRO) and FTX token (FTX).

NEXO holders are entitled to a number of benefits and advantages including better interest rates on their holdings and access to reduced rates on crypto-backed loans.

This token was released in late 2019 and has seen a huge price of over 2000%.

Does Nexo have a mobile app?

Nexo has a very intuitive iOS and Android app available for download on the App Store and Google Play Store. The Nexo mobile app is jam packed with features giving users access to a wide range of crypto related products available on their mobile phone. The app lets users login using facial recognition, otherwise known as biometric authentication, which adds an extra layer of security.