Quick take

Coinspot’s staking feature allows users to stake 20+ cryptocurrencies and earn up to 45% APY. ETH, ADA, SOL, DOT and AXS are just some of the crypto assets available for staking.

There are no fees for staking crypto on Coinspot, however, there are trading fees for buying and selling crypto on their platform.

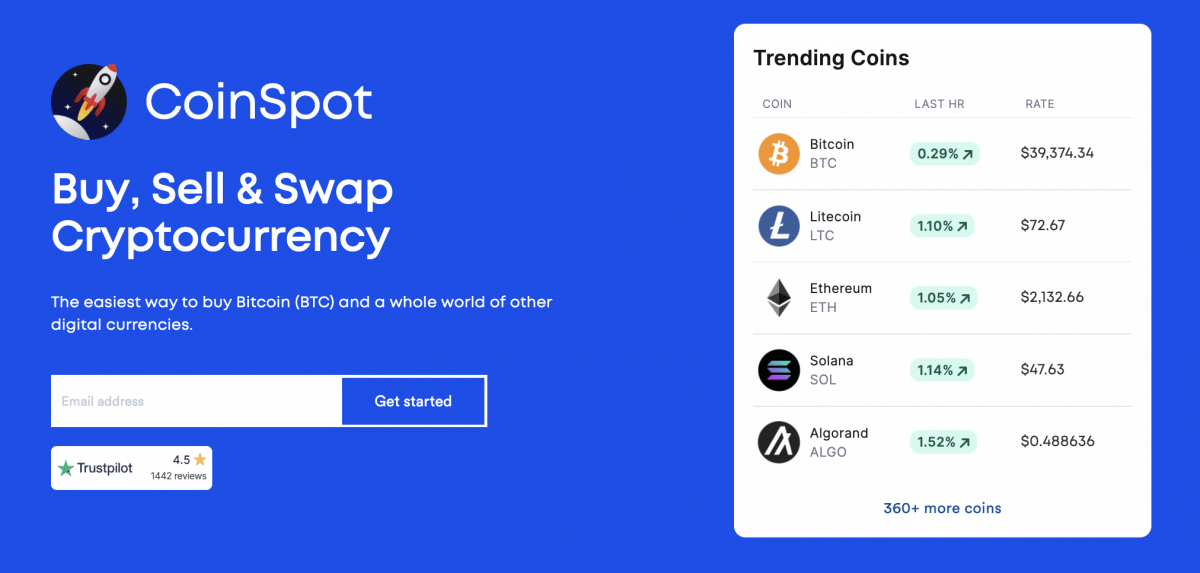

It’s no secret that Coinspot is extremely popular amongst Australian cryptocurrency investors. In 2023, the exchange reportedly has over 2.5 million users. One of the reasons that makes Coinspot so popular is its staking feature, allowing Aussies to earn passive income on cryptocurrencies they hold in their wallet.

This guide details the ins and outs of Coinspot staking including the fees, interest rates and eligible cryptocurrencies.

What is staking?

Put simply, crypto staking is a process by which you can earn interest (or ‘rewards’) on your cryptocurrency.

This is done by using cryptocurrency that is run on a Proof of Stake (PoS) blockchain. PoS is more secure and energy-efficient than the original model (called Proof of Work), that is used by large crypto assets like Bitcoin and Ethereum.

The PoS model of blockchain is used as a mechanism to validate transactions. Investors can ‘stake’ their coins in order to validate transactions and in exchange, earn rewards. Whilst staking, your cryptocurrency will be locked up until it is ‘unstaked.’

Although this seems like a complex process, many crypto exchange platforms like Coinspot have made staking simple for the everyday investor. Read on for more information about staking on Coinspot.

Can you stake crypto on Coinspot?

Yes. Coinspot launched its crypto staking feature in November 2021. Recently, however, the name of the feature has changed to ‘Earn,’ though the mechanics of how the feature work are still very much the same.

They currently have 22 cryptocurrencies that are eligible to be staked, however Coinspot have been consistently added more stakable assets since the launch of the feature.

For more information on Coinspot as a whole, visit our in-depth Coinspot review. Alternatively, you can stake crypto on several other platforms. Check out our guide to the best crypto staking websites in Australia.

Powerful crypto trading indicator

The Market Mapper is a custom trading indicator designed to execute accurate buy and sells signals for profitable crypto trading.

How to stake crypto on Coinspot

Staking crypto on Coinspot is a simple process. All you have to do is follow these five easy steps:

2. Deposit AUD via the ‘Deposit AUD’ tab

3. Purchase one of the stakeable cryptocurrencies via the ‘Buy/Sell’ tab

4. Choose the cryptocurrency you wish to stake via the ‘Wallets’ tab, then click ‘Earn’ on the left-hand side

5. Click the ‘Stake’ button to confirm

Once you have done this, you will immediately start to earn daily rewards. Visit the staking page in your wallet to view your daily rewards, rate of return, approximate payout amount, and more.

Start Staking With CoinspotWhat cryptocurrencies can you stake on Coinspot

Below is a list of the 23 staking options that Coinspot currently has available.

- Algorand (ALGO)

- Axie Infinity (AXS)

- Avalanche (AVAX)

- Binance Coin (BNB)

- Cardano (ADA)

- Cronos (CRO)

- Cosmos (ATOM)

- Elrond eGold (EGLD)

- Fantom (FTM)

- Flow (FLOW)

- Harmony (ONE)

- Polkadot (DOT)

- Solana (SOL)

- Kusama (KSM)

- Tezos (XTZ)

- Terra (LUNA)

- Kava (KAVA)

- Tron (TRX)

- Polygon (MATIC)

- Terra (LUNA)

- Verasity (VRA)

- Wanchain (WAN)

- Zilliqa (ZIL)

Related guide: How to buy Polygon in Australia

Coinspot staking rates

Staking rates on Coinsport are calculated based on Annual Percentage Yield (APY). APY refers to the annual rate of return on an investment, taking into account the impact of compound interest.

The below table contains the advertised APY for each of the crypto assets available for staking on Coinspot.

| Cryptocurrency | Interest rate (APY) |

| Algorand (ALGO) | 6% |

| Axie Infinity (AXS) | 45% |

| Avalanche (AVAX) | 6.9% |

| Binance Coin (BNB) | 3.5% |

| Cardano (ADA) | 3.3% |

| Cronos (CRO) | 7.8% |

| Cosmos (ATOM) | 8.5% |

| Elrond eGold (EGLD) | 13% |

| Fantom (FTM) | 4.2% |

| Flow (FLOW) | 6.5% |

| Harmony (ONE) | 7% |

| Polkadot (DOT) | 12.5% |

| Kusama (KSM) | 20% |

| Tezos (XTZ) | 4.2% |

| Kava (KAVA) | 20.5% |

| Tron (TRX) | 5.9% |

| Polygon (MATIC) | 12.8% |

| Terra (LUNA) | 8.1% |

| Veracity (VRA) | 19.2% |

| Wanchain (WAN) | 6.3% |

| Zilliqa (ZIL) | 15% |

Please note that APY is an estimate only and subject to fluctuations.

Coinspot staking fees

Coinspot does not charge any fees to stake cryptocurrency on their platform. There are fees, however, for buying and selling cryptocurrencies on Coinspot.

The risks of staking

The main risk of staking is the volatility of your investment – if the value of the coin drops, your rewards from staking that coin may not be enough to make up for the loss.

However, this is the risk that comes with all investments. Staking is not any riskier than any other form of investment. In fact, the rewards earned from staking may at least offset some of the loss of the price if your cryptocurrency drops (even if it is not enough to cover the entire loss).