23/05/2022 market update

Bias – turning bullish

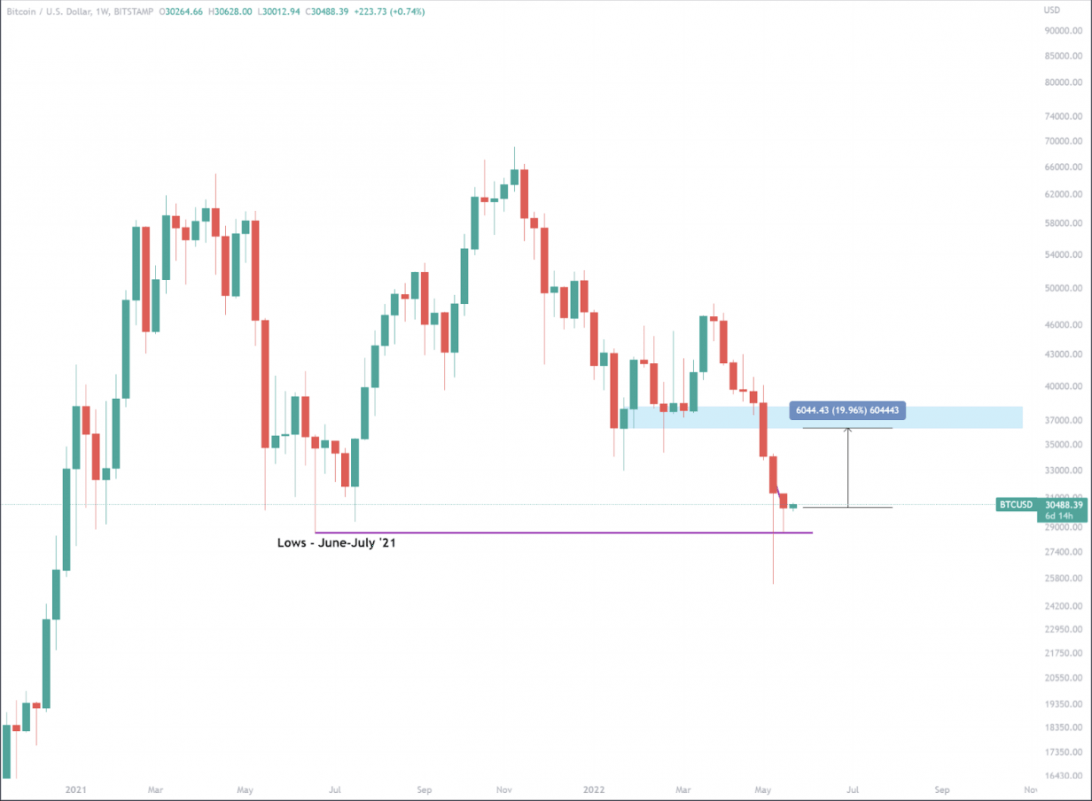

The weekly close has for two weeks now closed higher than the June-July 2021 lows. While markets are still not giving us clear signals on what direction is coming next – there is a great reason to be thinking a relief rally is coming.

Targets

$35,000-$38,000

The most recent support range we lost from the start of 2022, would be the most likely place price would gravitate towards from here should the bullish signs come to fruition.

Is there a chance for more downside to come?

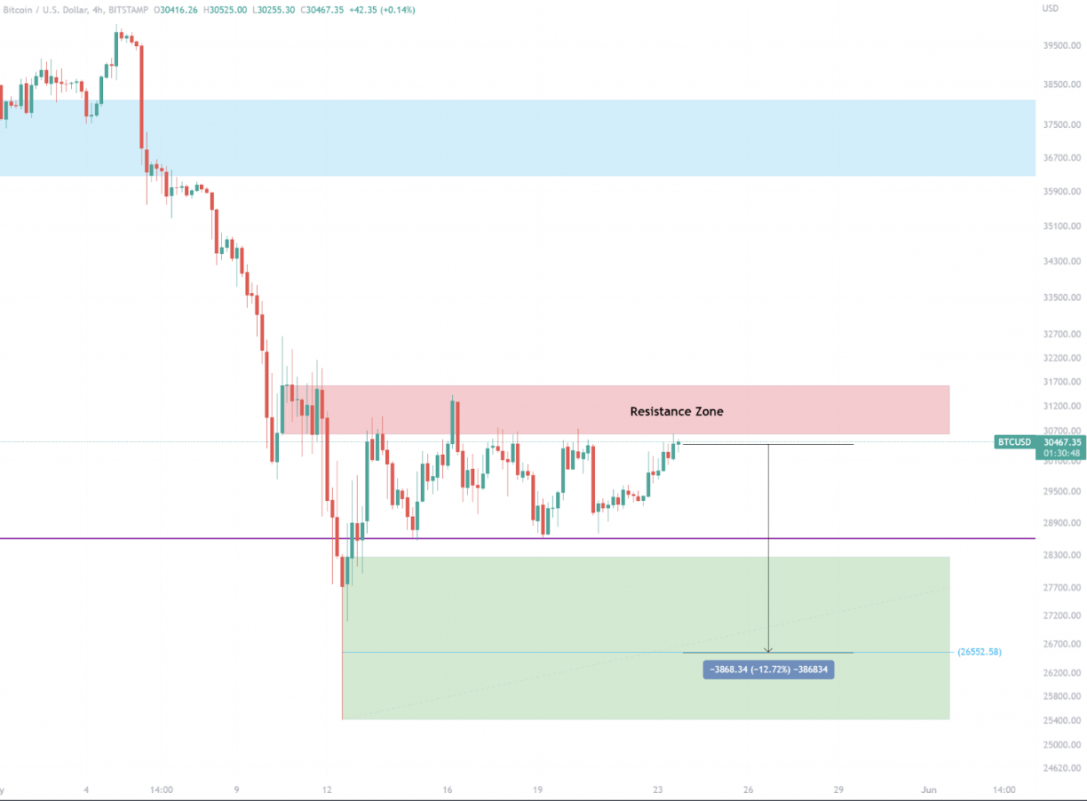

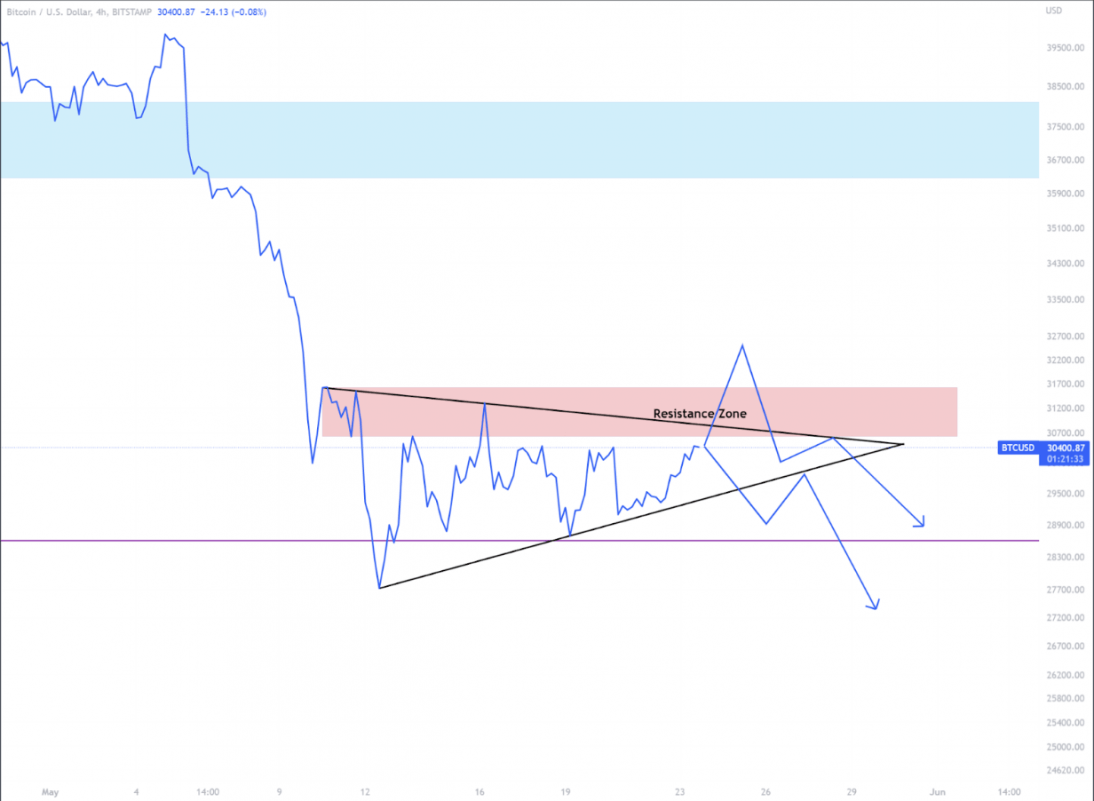

There is 100% a chance that before we trek higher to the target range, we do see price head back down towards the wicks on the above weekly chart. To help identify potential ranges we could visit, please see the below lower time frame chart.

I would be looking for price to head back to the original wick that was created at the current local low should this scenario play out. Often we can get what’s referred to as a pinbar retest, where price travels back towards the middle of the said wick. This would suggest $26,500 BTC could be on the cards.

What does it look like if we aren’t coming back down again

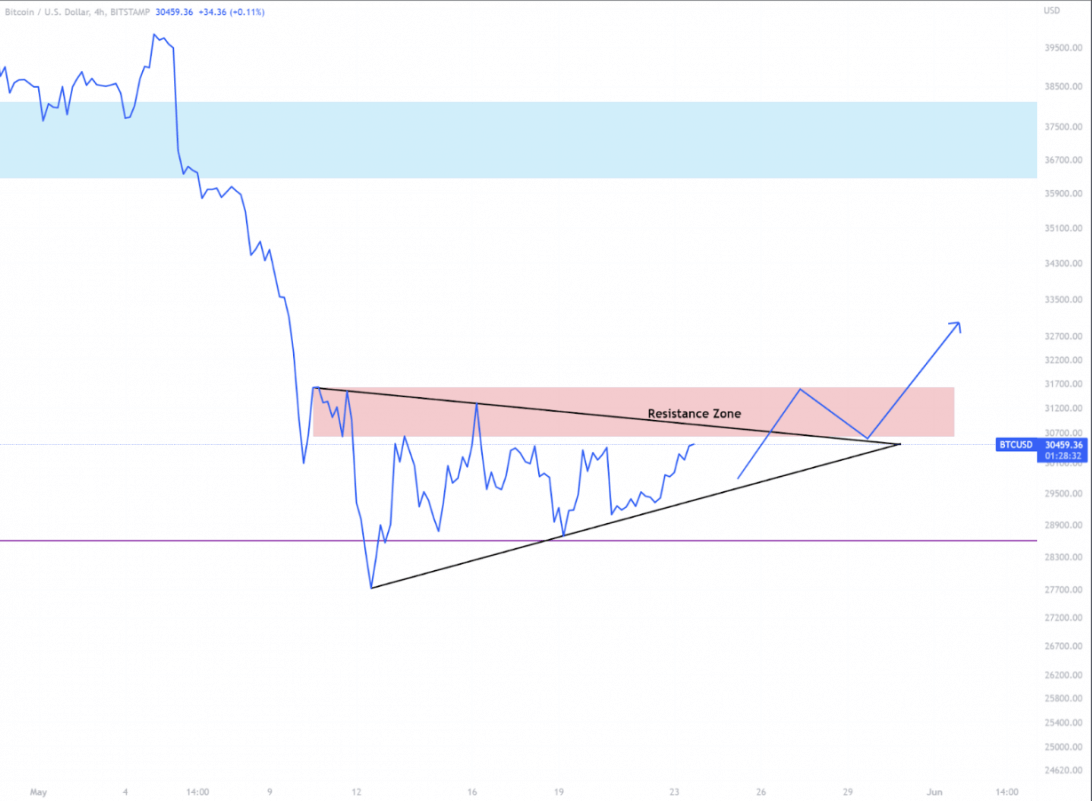

For the bullish perspective, this would be a breakout and retest scenario that we could say play out leading into a rally for the monthly close, and closing in on our target area.

Should the market follow the structure of a symmetrical triangle, we should expect volatility to decrease leading into the apex of the triangle.

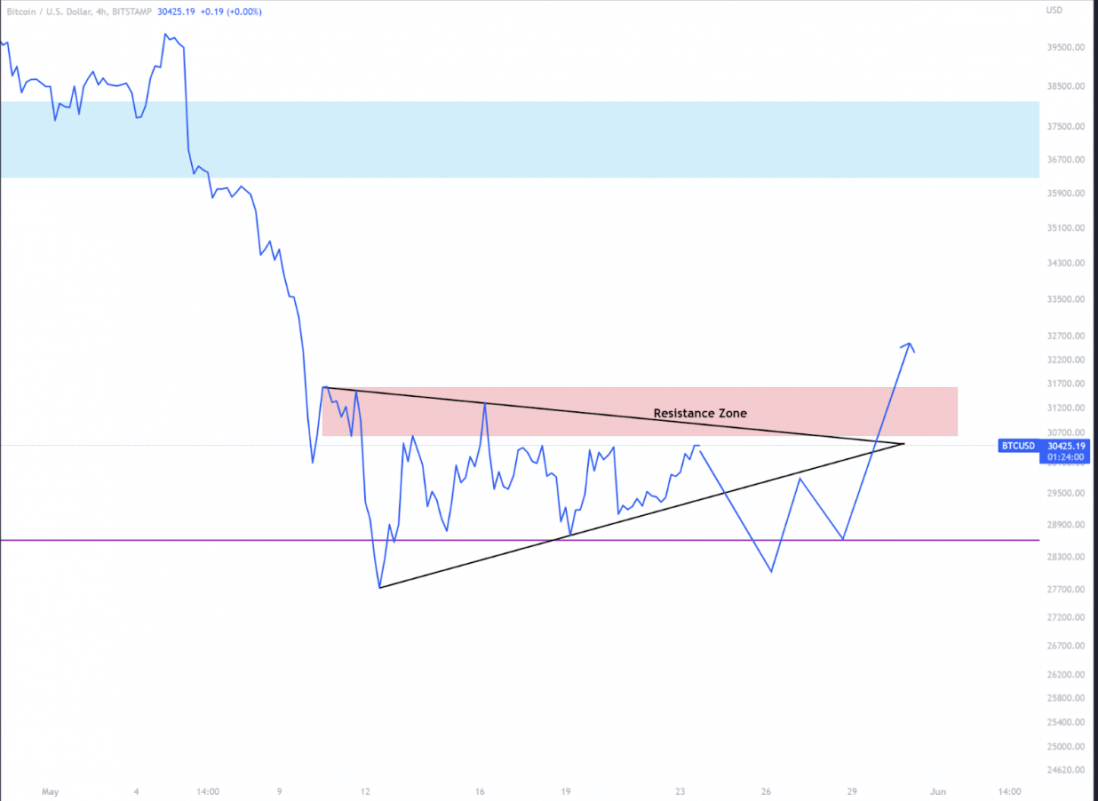

A Lower Low here would break this structure. However, another scenario that could play out is a fake-out to the downside before going higher. This is less common when price is manipulated to the downside, trapping bears and short-sellers. This is generally how we get very explosive moves to the upside when the time comes, in a phenomenon known as a short squeeze.

This would also support my original idea above, of testing lower before going higher.

What does failure look like?

Both situations show that failure to continue higher would be due to the absence of bulls in the market, standing ready to battle when they’re needed.

Related: Learn how to buy Bitcoin

Macro markets

The S&P 500 & NASDAQ are both showing similar signs of strength, which further supports the narrative of a “risk on” period approaching.

In summary

You can always wait for the above confirmation before committing to any positions. However in my opinion the narrative to drive higher here has never been better in recent weeks.

We are still a few months away from the next Fed meeting, after which we might see some more fear in the market. This meeting isn’t until the end of June, so plenty of runway to see some positive price movement in the coming weeks before the risk-off tone hits the markets again.