If you’ve heard the term “cryptocurrency,” you’re likely familiar with Bitcoin, the first and most well-known of these digital currencies. However, there are many other cryptocurrencies out there, and Ethereum is one of them. Ethereum is a blockchain-based platform that enables developers to build decentralised applications (dapps) and run smart contracts. In this blog, we’ll explore what Ethereum is, how it works, and why it’s unique in the world of cryptocurrencies.

What is a Blockchain?

Before diving into Ethereum, it’s important to understand what a blockchain is. At its most basic level, a blockchain is a digital ledger that records transactions in a decentralised and secure way. In other words, it’s a database that is distributed across a network of computers, rather than being stored in a single location. Each block in the chain contains a record of transactions, and once a block is added to the chain, it cannot be altered or deleted. This creates a secure and transparent record of all transactions on the network.

What Makes Ethereum Unique?

While Bitcoin is primarily used as a digital currency, Ethereum is different in that it’s a platform for building dapps and running smart contracts. Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. These contracts are executed automatically, without the need for intermediaries like lawyers or banks.

One way to think of Ethereum is as a decentralised computer. The Ethereum network consists of a series of nodes (computers) that run the Ethereum software. Developers can write code that runs on the Ethereum Virtual Machine (EVM), which is a runtime environment for smart contracts. These contracts are executed on the nodes that make up the Ethereum network, and the results are recorded on the blockchain.

ETH and Gas

Like Bitcoin, Ethereum has its own cryptocurrency, called Ether (ETH). Ether is used to pay for transactions on the Ethereum network, and it’s also used to incentivise miners. Miners are individuals or organisations that use their computing power to verify transactions on the network and add new blocks to the blockchain. In return for this work, miners are rewarded with Ether.

One unique aspect of Ethereum’s proof of stake consensus algorithm is the concept of gas fees. Gas fees are the fees that validators and users pay in Ether for each transaction on the network. The amount of gas required for a transaction depends on the complexity of the transaction and the amount of computing resources needed to execute it. This helps to prevent spam and other types of attacks on the network, as users and validators are required to pay for the computing resources they use. With the move to proof of stake, Ethereum aims to reduce the amount of energy consumption associated with proof of work and provide a more secure and sustainable network for users and validators alike.

How to buy ETH in Australia

The process of buying ETH in Australia has become quite simple and can be done in a number of steps:

- Register an account with an Australian crypto exchange

- Complete account verification

- Enable Two-Factor Authentication (2FA)

- Deposit funds (AUD) into your account

- Buy Ethereum

View our detailed guide for a full breakdown of how to buy Ethereum (ETH) in Australia.

Applications of Ethereum

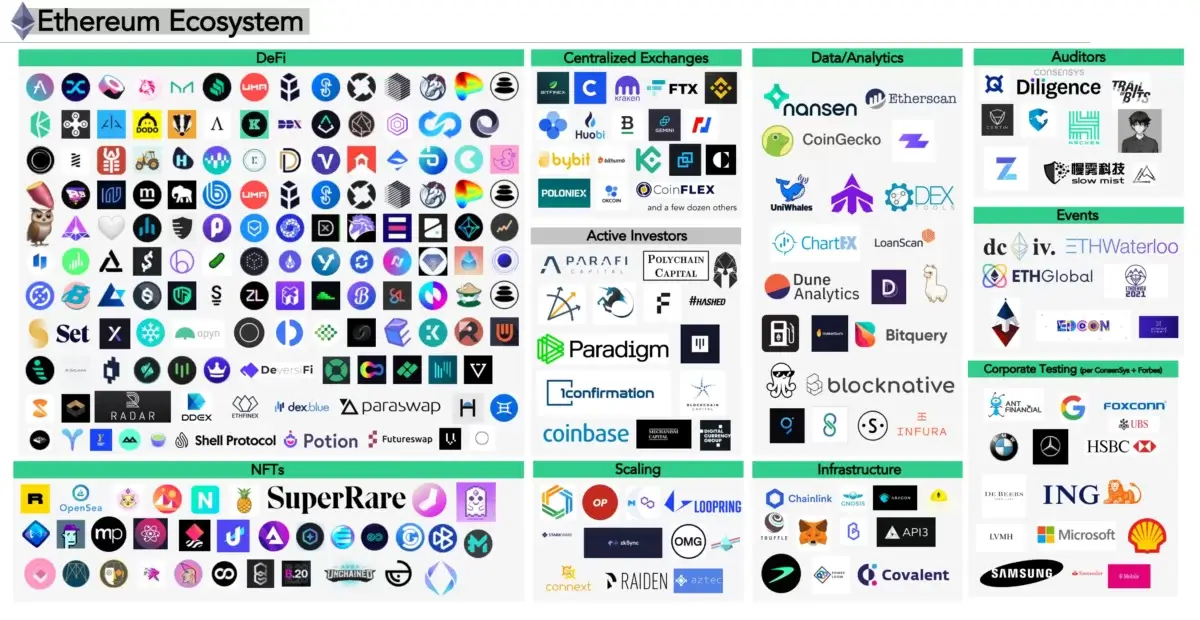

The applications of Ethereum are broad and varied. One example of a dapp built on Ethereum is Uniswap, a decentralised exchange for trading cryptocurrencies. Another example is Augur, a decentralised prediction market. Because Ethereum is a platform for building dapps, developers have the ability to create virtually any type of application on top of it.

One area where Ethereum is particularly promising is in the world of decentralised finance (DeFi). DeFi refers to financial applications built on top of blockchain technology, which aim to create a more open and transparent financial system. Some examples of DeFi applications built on Ethereum include decentralised lending platforms, stablecoins (cryptocurrencies that are pegged to the value of a stable asset, like the U.S. dollar), and automated market makers.

Popular ethereum dapps

There are many popular Ethereum dApps (decentralised applications) that have gained significant traction and adoption in the blockchain space. Some of the biggest and most popular Ethereum dApps are:

- Uniswap: A decentralised exchange that allows users to trade cryptocurrencies without the need for a central authority.

- Metamask: A popular Ethereum wallet and browser extension that allows users to interact with dApps on the Ethereum blockchain.

- OpenSea: A decentralised marketplace for buying, selling, and trading non-fungible tokens (NFTs) on the Ethereum blockchain.

- Axie Infinity: A blockchain-based game that allows users to collect, breed, and battle digital creatures known as Axies.

The Ethereum roadmap

Ethereum’s roadmap aims to make the platform more scalable, secure, and sustainable while maintaining its core principles of decentralization and censorship-resistance. The roadmap is divided into several stages, each with specific upgrades and goals.

The first stage, “The Merge,” involves upgrading Ethereum from proof-of-work to proof-of-stake, which will improve network security and reduce energy consumption. This upgrade is expected to take place in 2022.

The second stage, “The Surge,” focuses on scalability improvements through the use of rollups and data sharding. These upgrades will increase transaction throughput and reduce gas fees, making the platform more accessible and usable for everyone.

The third stage, “The Scourge,” tackles censorship resistance, decentralization, and protocol risks from MEV. The upgrades in this stage aim to make Ethereum more resilient to attacks and protect user privacy.

The fourth stage, “The Verge,” is focused on making it easier to verify blocks, which will improve security and reduce the risk of fraud on the platform.

The fifth stage, “The Purge,” aims to reduce the computational costs of running nodes and simplify the protocol, making it easier for developers to build on Ethereum.

Finally, the sixth stage, “The Splurge,” includes upgrades that don’t fit well into the previous categories but are still important for improving the platform’s functionality and usability.