Quick summary

You can invest in cryptocurrency and digital assets through your Self Managed Superfund (SMSF). The tax structure for SMSFs is quite generous, making this form of investment quite popular amongst Australians. Most crypto exchanges support SMSFs, allowing users to trade easily via their SMSF account.

There are a multitude of ways to invest in cryptocurrency. Popular for its ability to deliver large returns, cryptocurrency has a reputation for being very volatile. For this reason, many crypto investors have looked to Bitcoin as a short term investment.

However, if you are looking to use your crypto investments to cultivate long-term gains, you may want to consider other methods of investment. One long-term investment vehicle that has recently been attracting attention is self-managed super funds (SMSFs). SMSFs are a great way to invest your cryptocurrency to build and gain long term exposure into digital assets.

This page will explain the basics of SMSFs and discuss the advantages and disadvantages of investing in crypto with an SMSF. At the end of this page, we will provide steps on how to invest in crypto with your SMSF.

What is an SMSF?

In simple terms, a super fund is a compulsory trust structure that allows you to save money for retirement. In most cases, your employer will put away a certain portion of your salary into a super fund as retirement savings. You cannot access this money during your working life (with exceptions), as it is invested on your behalf. However, as soon as you retire, this money is yours to do as you please. During the time that you cannot access your super account, a board of directors at the particular super company will manage the funds for your benefit. Your funds will be invested based on the fund’s investment strategy.

On the other hand, a self-managed super fund (SMSF) has the same structure as a regular super fund with the exception that you have direct control over the fund (as the name suggests). In this way, the trustee (or trustees) who manages the SMSF will also be the beneficiary (or beneficiaries) of the SMSF. For example, if you manage an SMSF, you are responsible for selecting the types of investments within the SMSF. You are also responsible for complying with the super and tax laws.

What assets can you include in an SMSF?

As you are responsible for managing your SMSF, you will choose the assets to include in the SMSF. For this reason, it’s wise to know what asset classes can be included.

In 2021, the ATO published a comprehensive list of the most popular asset classes based on lodged SMSF annual returns for the financial year ending June 2019. Understandably, listed shares, cash deposits and real estate and property were among the highest allocated personal assets in Australian SMSFs. Interestingly, alternative investments such as collectables (for example, artworks), insurance policies and cryptocurrencies are also included in this list.

According to these figures, cryptocurrency currently makes up only 0.02% of total Australian assets invested in SMSFs. However, you can expect this number to steadily increase as time goes on due to the growing popularity of cryptocurrency SMSFs. Strong growth can also be expected of crypto SMSFs as the figures reveal that lower balance SMSFs have some of the highest allocation of cryptocurrency. This reflects the greater acceptance of cryptocurrency among younger people who have not yet had time to build their account balance.

Are cryptocurrency SMSFs legal in Australia?

In short, cryptocurrency SMSFs are legal in Australia. However, investing in a crypto SMSF requires a high level of compliance with Australian regulations. For example, you must keep a comprehensive record of your trades so that they can be reviewed and taxed accordingly.

There are few basic rules to remember when setting up your cryptocurrency SMSF, as set out below. However, it is always best to seek professional advice to ensure that your SMSF is compliant and not breaching any rules or regulations.

SMSF regulations in Australia

The primary legislation relating to the superannuation industry is the Superannuation industry (Supervision) Act. You should keep up to date with any changes to this Act during the lifetime of your SMSF.

The ATO is the regulatory body for SMSFs. The ATO website publishes plenty of information about SMSF compliance issues. Be sure to check out the ATO website when setting up your SMSF.

Sole Purpose test

The sole purpose of an SMSF is to provide retirements benefit to members (or their dependents upon the death of a member before retirement). Therefore, you are generally not able to obtain any financial benefits from the SMSF while investing – the benefits can only be accessed upon retirement.

If you obtain a pre-retirement benefit from your SMSF, you may have contravened the sole purpose test. Trustees will be penalised for any contravention.

To comply with the sole purpose test, SMSF investments cannot be mixed up with personal investments and you cannot gain benefit from the investments. For example, you cannot own an investment property in conjunction with your SMSF as this blurs the lines between personal and super fund investments. Similarly, you cannot live in a home owned by your SMSF as you would be gaining benefit from the investment. In another example, you cannot display an artwork in your home that is owned by your SMSF, as you are gaining benefit from its display.

When it comes to cryptocurrency, the crypto itself must be held securely in a public IP address to show that it belongs to the SMSF (and is not owned by you as an individual). You must also not receive dividends, payouts or staking rewards from your crypto investments while they are included in the SMSF.

If your SMSF meets the sole purpose test (among other requirements), you may be eligible for tax concessions.

How to set up crypto SMSF account

To set up your crypto SMSF account, you must first ensure that your SMSF is set up correctly so that it’s eligible for tax concessions, can receive contributions and is easy to administer. Make sure you refer to the ATO’s resources to check that your SMSF is compliant and ready to invest.

Once you have set up your SMSF, you will need to choose which cryptocurrency exchange that best suits your needs.

Which crypto exchanges offer an SMSF service?

With the above information in mind, it is now time to pick an exchange. Swyftx, Digital Surge and Coinspot are the highest rated exchanges on the market for SMSFs. Read below to figure out which is the best exchange for your cryptocurrency SMSF needs.

Swyftx

Swyftx is one of our favourite Australian cryptocurrency exchanges, offering low fees, free deposits and withdrawals and low spreads. Additionally, Swyftx also has a unique demo mode, which allows you to test out your investment strategy using mock money.

Swyftx has a sub account for SMSF. This means you’ll need to sign u for a personal account before you apply for an SMSF account.

Do not ever invest SMSF funds into you personal account as this is not compliant with laws and regulations and will carry serious tax consequences.

Digital Surge

As you may be aware from reading our other pages, Digital Surge has the lowest fees and spreads of any Australian cryptocurrency exchange. For this reason, Digital Surge is a trusted exchange among those looking to invest in cryptocurrency SMSFs.

Digital Surge also offers the necessary transaction reporting for its specialist SMSF accounting platform to ensure all trades, balances and capital gains cost-base information is accurate and reconciled. The platform’s end of financial year accounting abilities also make it easy to report your annual tax.

CoinSpot

CoinSpot is Australia’s biggest crypto exchange with over 2.5 million users. It offers a myriad of different cryptocurrencies, which makes it easy to diversify your SMSF investments. However, the main drawcard for CoinSpot is that it is the most audited and trusted exchange in Australia.

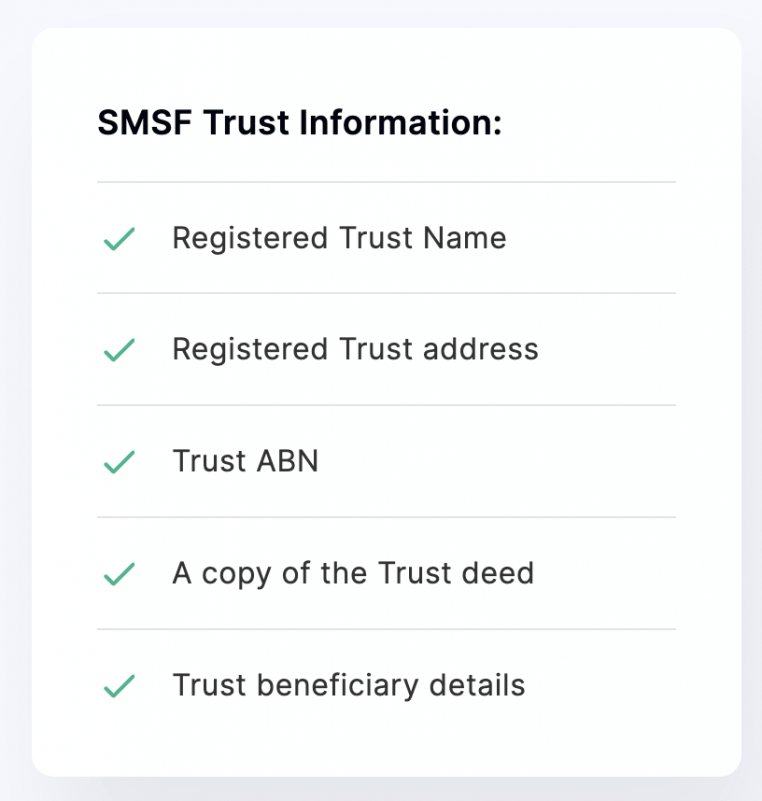

When it comes to cryptocurrency SMSF, Coinspot has a simple application form. The following image shows what is required when applying:

Tax rate of SMSFs in Australia

The Australian Tax Office (ATO) considers Bitcoin and cryptocurrency as an asset rather than currency. It is therefore subject to Capital Gains Tax (CGT) which is applied to every trade you make through your SMSF.

As crypto is considered a capital gain asset for tax purposes, the fund’s trust deed and investment strategy would need to allow for cryptocurrency and other digital assets.

SMSF legislation provides a generous tax structure to invest in cryptocurrency. If your SMSF meets the requirements, it will be eligible for a tax concession at a lower rate of 15%. Any long-term gains are taxed at an even more competitive rate of 10%.

The low tax rate is one of the main factors that makes SMSFs a desirable option for cryptocurrency investment.

Advantages of investing in crypto with SMSF

There are numerous advantages to investing in crypto with an SMSF. A brief summary of the main advantages are listed below.

Choose your own investments

SMSFs can invest in almost any type of asset (with some exceptions, of course). This range of investment opportunities grants trustees the freedom to diversify their portfolio and follow market trends.

With cryptocurrency becoming an increasingly popular asset class, SMSFs are an ideal vehicle in which to invest cryptocurrency. Many Australian exchanges (such as Swyftx, Digital Surge and CoinSpot) allow accounts to be opened in accordance with the strict SMSF requirements. Principally, this involves your cryptocurrency SMSF investments being clearly and identifiably separate from your personal investments.

Control over your fund

As per the name, SMSFs permit a greater degree of self-management than regular industry super funds. The members of the funds are also the trustees, so there is flexibility to tailor the SMSF to suit the members’ specific needs.

Additionally, overseeing your own SMSF investments means you can easily buy, sell and switch crypto assets depending on the market. Quick trades and adjustments can be made on short notice, allowing you to take advantage of sudden investment opportunities (or avoid the repercussions of bad investment decisions).

Lower tax

As mentioned above, SMSF investments can be taxed at a low rate of 15%. This is the same rate for retail and industry super funds. Long-term capital gains are subject to an even lower tax rate of 10%.

You may also be able to enact further tax strategies suited to your personal circumstances. It is recommended to consult a tax professional in this regard.

Disadvantages of investing in crypto with SMSF

Despite the many advantages of investing in crypto with an SMSF, there are some disadvantages to consider.

Trustee responsibilities

Trustees of SMSFs bear a great responsibility in ensuring their SMSF is compliant (not to mention beneficial). SMSF legislation and regulation is lengthy and complex and will usually require a professional to assist in interpreting and observing. The ATO can impose high penalties on trustees that are found not to be complying with SMSF regulations.

In addition to ensuring the compliance of the SMSF, trustees are tasked with ensuring that it is beneficial to its members. After all, an SMSF is designed to provide benefit upon retirement, meaning that the SMSF investments must be fruitful. Trustees have the responsibility of choosing investment strategies, which at times can be a lot of pressure.

Takes a lot of time and effort

As with most investment vehicles, SMSFs take time and effort to establish and manage. Particularly, the management requirements are ongoing for the lifetime of the SMSF.

Additionally, cryptocurrency is inherently volatile. Trustees looking to maximise their retirement benefits may wish to keep up with current markets trends and developments. Inevitably, this requires time and effort.

In addition to trading and researching, the record keeping requirements are stringent. Records of crypto investments should be kept for up to 5 years, and include information such as quantity, sale price, date of acquisition, costs and fees paid and digital wallets details. This will ensure that the cryptocurrency SMSF can be taxed accurately and appropriately.

Must be residing in Australia

A compliant SMSF must meet the residency rules. The residency rules require an SMSF to meet the following three criteria:

- The SMSF must be established in Australia

- The central management and control of the SMSF must ordinarily be undertaken in Australia

- At least 50% of the SMSF members must reside in Australia

If you’re looking to invest in crypto with your SMSF, you should consider your future plans. For example, do you plan to move overseas in the near future? Do you plan to make contributions to your SMSF whilst temporarily overseas? Likewise, keep in mind the future plans of the SMSF’s other members as all members’ activities affect the success of the SMSF.

Can I move my crypto out of an exchange?

It is possible to move your crypto out of an exchange. The best option is to send your crypto into a hardware wallet for long-term safe storage. A hardware wallet is a cold storage wallet which means your crypto is stored offline, mitigating the risk of online attacks and scams.

You can keep your crypto on the exchange you bought it on (Swyftx, Digital Surge, Coinpot) but for maximum security, ensure that you have a unique password and have Two-Factor Authentication (2FA) set up.