Best staking platform: Coinspot

Overall, we consider Coinspot to be the best staking platform available to Aussies. We made this decision based on the following factors: ease of use, number of assets available for staking, fees, interest/rewards offered on assets, payout frequency and lock up periods.

If you have just started to look into cryptocurrencies, you will likely have come across staking. Staking is a fantastic way to earn passive income on crypto assets without lifting a finger. Some crypto staking platforms in Australia allow users to simply start staking certain cryptocurrencies with the click of a button.

At Coinware, we’ve done our research to uncover the best platforms to stake crypto in Australia in 2023. This guide has fleshed out each of these options but to summarise these are our top picks:

- Coinspot – best Australian crypto staking platform

- Binance – most available coins for staking

- Crypto.com – gain additional benefits from staking

- Coinbase – easy-to-use staking platform

- Ledger – stake through your hardware wallet

- Nexo – interest-earning and crypto lending

- Finder – Australian stablecoin yield

What is staking?

Staking involves locking up your crypto on a Proof-of-Stake blockchain network to verify and secure transactions without the need for a central authority. Users who stake their crypto can then earn interest which is presented as a percentage of the coin they are staking.

This is considered a safe and secure method to earn additional tokens on top of the crypto you already own.

The pros and cons of staking?

| Pros of cryptocurrency staking | Cons of cryptocurrency staking |

| High-interest returns compared to banks | Price volatility – the price of the cryptocurrency you’re staking could drop in value |

| Some offer interest on a daily basis – compounds daily | Hacks – the custody provider that you’re staking with could get hacked |

| Some allow you to withdraw your staked crypto at any time | Not your keys not your crypto – staking your crypto with third-party provider means they technically on your crypto |

| Most offer fee-free staking | Some require you to lock up your crypto for a certain period of time |

What is the best crypto staking platform in Australia?

Below we’ve listed the 5 best staking platforms in Australia. We have compiled this list based on a number of factors including eligible staking cryptocurrencies, staking rates (APY’s), ease of use, lock-up periods and fees.

1. Coinspot Staking

| Stakable cryptocurrencies | 22 |

| Fees | No fee |

| Earn up to | 78% APY (on AXS) |

| Minimum staking amount | No minimum |

| Is there a lock-up period? | No |

| Earn yield on stablecoins? | No |

| Payout frequency | Daily |

Coinspot is another Australian crypto exchange that offers staking to its users. They currently have 22 cryptocurrencies for staking within the app.

Coinspot has also changed the name of their feature to ‘Earn.’ This feature allows you to earn an Annual Percentage Yield (APY) by lending certain cryptocurrencies you hold in your Coinspot wallet.

The highest APY you can earn is on Axie infinity, which Coinspot offers 78% APY on. Other high-interest yields coins include:

- Kava (KAVA) – 23.5%

- Kusama (KSM) – 18.5%

- Verasity (VRA) – 18.25%

- Polygon (MATIC) – 12.8%

- Polkadot (DOT) – 12.5%

How to use Coinspot Earn

Coinspot have made the process of earning/staking extremely seamless and easy. Simply select ‘Earn’ from the ‘Wallets’ tab at the top of your dashboard.

Then choose the coin you’d like to earn on and select how much you wish to lend. Once you have confirmed this, you will be able to see your approximate payout amount as well as the rate of return.

Visit our dedicated Coinspot staking page for more information or get a full review of the Coinspot exchange.

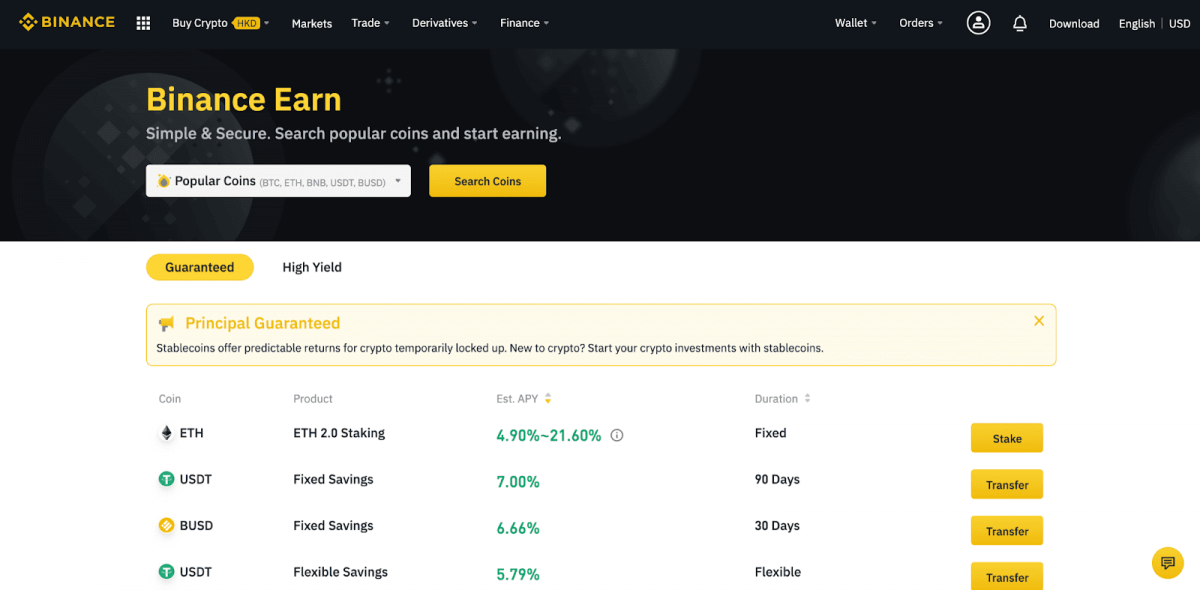

2. Binance Earn

| Stackable cryptocurrencies | 100+ |

| Fees | No fee |

| Earn up to | 106% APY (on OM) |

| Minimum staking amount | No minimum |

| Is there a lock-up period? | Flexible and locked staking |

| Earn yield on stablecoins? | Yes |

| Payout frequency | Daily |

Binance is the world’s largest cryptocurrency and a leading crypto staking platform. They offer staking on 100+ cryptocurrencies which is far more than any of the other platforms on this list. Binance is a great platform for users who hold a range of coins in their portfolio and want to earn passive income on them. Binance offers two taking options:

- Flexible staking

- Locked staking

Flexible staking gives you more freedom when locking up your coins. It enables you to withdraw your crypto from staking whenever you’d like. There are fewer coins available for flexible staking and the rewards are typically lower.

Locked staking, on the other hand, involves locking up your coins for a set period. During the lock-up period, if users choose to withdraw their staked coins before the period ends, they will lose the rewards. The benefit of locked staking is the rewards are much higher than flexible staking.

Related: Binance Australia review

Join Binance

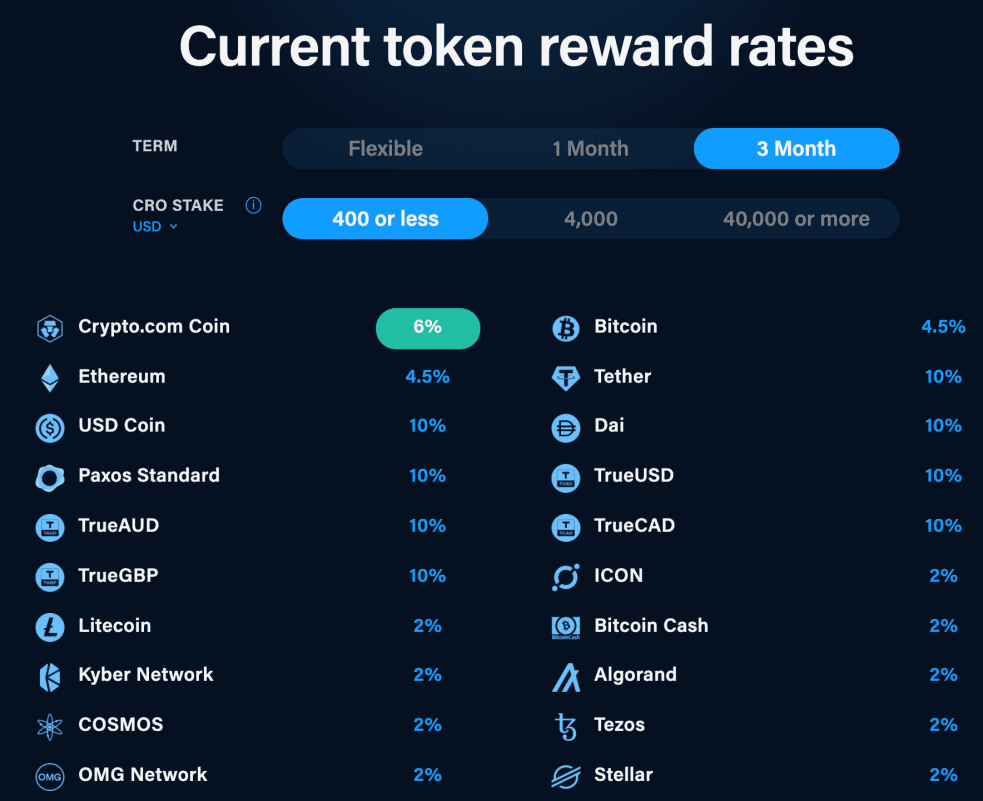

3. Crypto.com Earn

| Stakable cryptocurrencies | 50+ |

| Fees | No fee |

| Earn up to | 12.5% (on DOT) |

| Is there a lock-up period? | Flexible and locked staking |

| Minimum staking amount | No minimum |

| Earn yield on stablecoins? | Yes |

| Payout frequency | Weekly |

Crypto.com is one of the world’s biggest cryptocurrency exchanges, offering users a huge range of handy features and benefits. One of these features is staking, or ‘Earn’ as they refer to it. You can stake over 50 cryptocurrencies on Crypto.com, earning up to 10% on stablecoins and 14.5% on cryptocurrencies.

Like Binance, Crypto.com offer flexible and locked staking. With flexible staking, you can withdraw your cryptocurrency, along with the rewards you’ve earned at any stage. Alternatively, by staking and locking your crypto up for a 1 or 3 months, you can get better interest rates.

To get the best possible interest rates from staking, you must hold the Cronos coin (CRO), which is the token of the Crypto.com exchange. This is broken down into the following tiers:

- Normal rate – for users who $400 USD equivalent or less of CRO

- Improved rate – for users who hold $4,000 USD equivalent or more of CRO

- Highest rate – for users who hold $40,000 USD equivalent or more of CRO

Crypto.com offers staking on 3 stablecoins – TAUD, USDT and USDC. The interest available by staking stablecoins is typically much higher than the interest rates offered by ‘high interest savings accounts’ at most banks.

Join Crypto.com

4. Digital Surge Staking

| Stakable cryptocurrencies | 11 |

| Fees | No fee |

| Earn up to | 23% (on KAVA) |

| Minimum staking amount | N/A |

| Is there a lock-up period? | No |

| Earn yield on stablecoins? | No |

| Payout frequency | Monthly |

Digital Surge recently launched a crypto staking feature on its platform, allowing users to earn staking rewards on their crypto portfolio and crypto SMSF.

Much like the Digital Surge trading platform, this new feature is extremely easy to use, even for beginners. This works by lending your crypto to Digital Surge and then entering into an agreement to receive the interest in return.

Unlike a typical loan, Digital Surge allows you to withdraw your crypto from the Earn program at any stage.

To start staking on Digital Surge, purchase an eligible staking cryptocurrency and select how much you’d like to stake. Then simply confirm your order and start earning monthly rewards!

Learn more about Digital Surge fees, features and risks in our comprehensive Digital Surge review.

Join Digital Surge

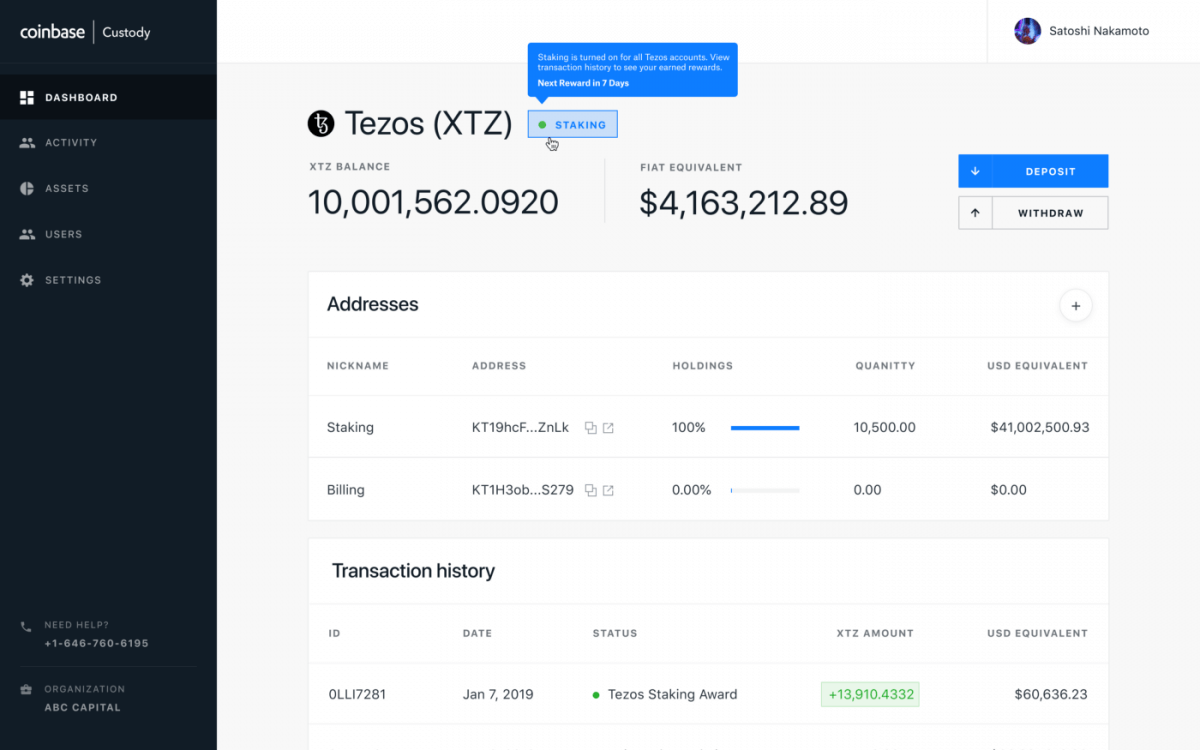

5. Coinbase Staking

| Stakable cryptocurrencies | 6 |

| Fees | No fee |

| Earn up to | 5.75% (on ALGO) |

| Minimum staking amount | $1 |

| Is there a lock-up period? | No |

| Earn yield on stablecoins? | Yes |

| Payout frequency | Monthly |

Coinbase is another large crypto exchange based in the US. Out of all the companies on this list, Coinbase is the only one to be publicly listed on the stock market after it went public on the NASDAQ in 2021. This means you can buy shares in Coinbase and trade crypto through it’s platform.

Coinbase offers staking on the following cryptocurrencies:

- Ethereum (ETH) – 3.675% APY

- Algorand (ALGO) – 5.75% APY

- Cosmos (ATOM) – 5.00% APY

- DAI – 0.15% APY

- Tezos (XTZ) – 4.63% APY

- USD Coin (USDC) – 0.15% APY

- Cardano (ADA) – 2.60%

Though Coinbase only offers staking on 6 cryptocurrencies, their staking feature is easy to use, which is particularly important for beginners.

For those who are more risk adverse, Coinbase offers staking on two stablecoins: DAI and USDC. Stablecoins are be pegged to the value of a fiat currency like the US dollar, so they’re designed to be non-volatile. This means you can earn higher interest rates than banks without exposing yourself to the risk associated with cryptocurrency investing.

Read our comprehensive Coinbase review to find out more about the exchange.

Join Coinbase

6. Ledger

| Stackable cryptocurrencies | 6 |

| Fees | No fee |

| Earn up to | 20% APY (on ATOM) |

| Minimum staking amount | No minimum |

| Is there a lock-up period? | No |

| Earn yield on stablecoins? | No |

| Payout frequency | Varies |

Ledger is one of the most established and renowned hardware wallet companies in the world. Its main products, the Ledger Nano X and Nano S, are considered to be some of the best hardware wallets on the market.

Ledger support staking for some Proof of Stake (PoS) assets including Algorand (ALGO), Cosmos (ATOM), Polkadot (DOT), Solana (SOL), Tezos (XTZ) and Tron (TRX).

How do I stake on Ledger?

You might be wondering “Ledger is a hardware wallet – how on earth can you stake your crypto.” Ledger staking is done through Ledger Live which is an online hub to manage your Nano device. The difference between staking through Ledger Live and staking on an exchange is that you own your private keys. Here is how to stake through Ledger:

- Purchase crypto through Ledger Live or transfer crypto to your ledger device from an exchange or another crypto wallet

- Click the “earn rewards” button on the coin you want to stake

- When choosing a validator, select Ledger

- Select how much you wish to stake

- Confirm

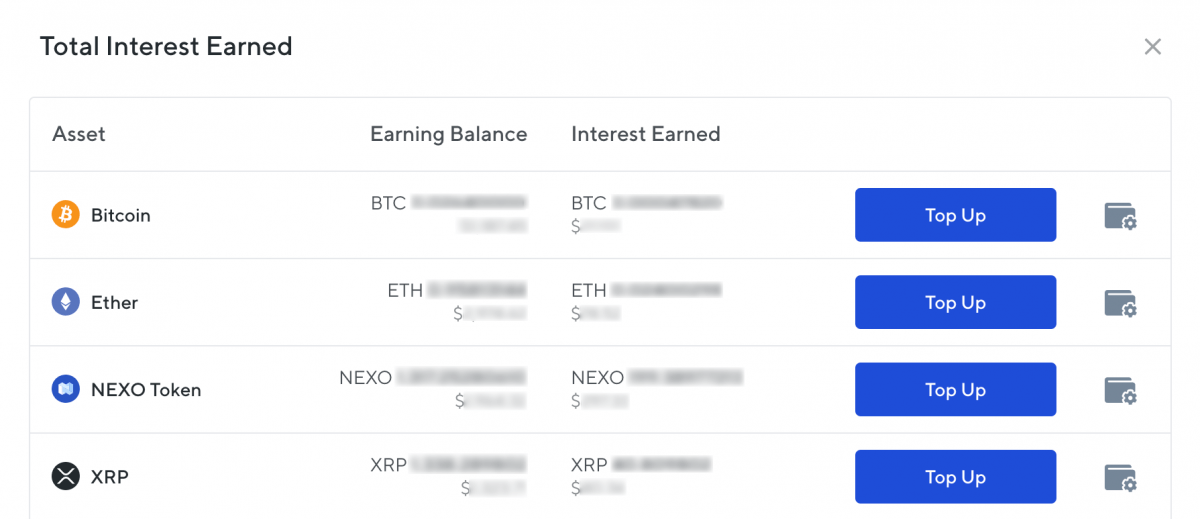

7. Nexo

| Stackable cryptocurrencies | 20+ |

| Fees | No fee |

| Earn up to | 16% APY (on MATIC) |

| Minimum staking amount | No minimum |

| Is there a lock-up period? | No |

| Earn yield on stablecoins? | Yes |

| Payout frequency | Daily |

Nexo is a crypto-backed loans platform meaning that you can take out a loan and use your crypto holdings as collateral. If you default on your loan repayments, this means that your crypto holdings may be used to pay off the loan.

Nexo also allows you to earn interest on all of the cryptocurrencies supported by the platform. There are currently 30+ listed cryptocurrencies on Nexo including BTC, ETH, SOL, ADA, USDT and much more.

Similar to other platforms on this list, Nexo gives you access to better interest rates if you hold a certain amount of the NEXO token. You can also get a loan and pay back less interest when you hold this token.

The following are the highest rates you can access on the Nexo platform.

- Axie Infinity (AXS) – 36% APY*

- Thorchain (RUNE) – 18% APY*

- Polygon (MATIC) – 16% APY*

- Polkadot (DOT) – 15% APY*

*If you hold a certain amount of NEXO token. Read this blog for a full breakdown of the Nexo loyalty tiers.

Nexo has a $375 million insurance policy in place to cover customers’ funds in the case that are stolen or the platform is hacked.

Get a full breakdown of the Nexo platform on Coinware’s Nexo review page.

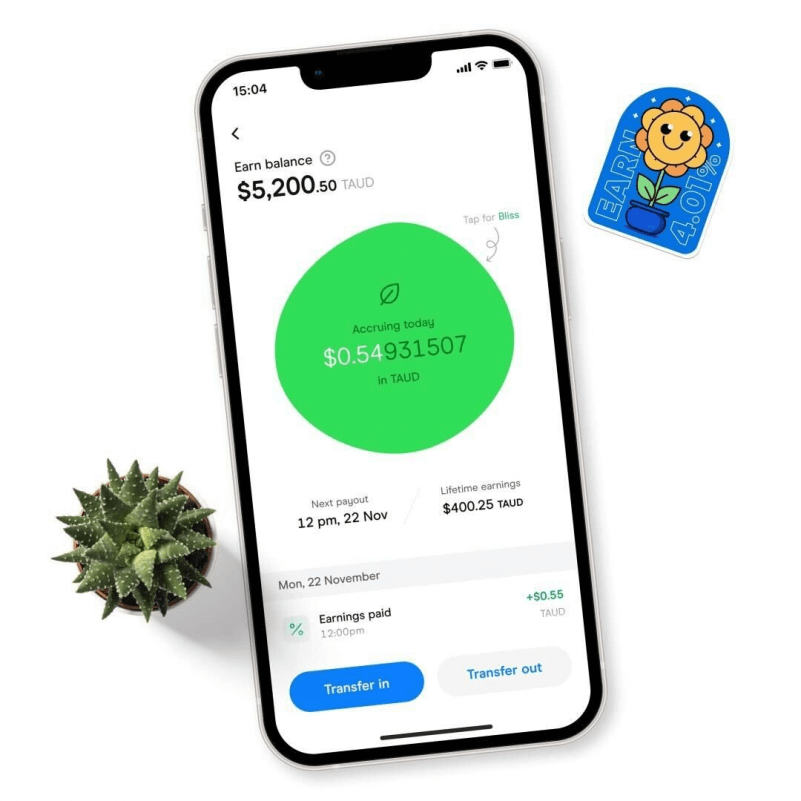

8. Finder

| Stakable cryptocurrencies | 1 |

| Fees | No fee |

| Earn up to | 6.01% (on TAUD) |

| Minimum staking amount | $25 |

| Is there a lock-up period? | No |

| Earn yield on stablecoins? | Yes |

| Payout frequency | Daily |

Finder.com.au is Australia’s biggest comparison website, providing detailed analysis on a 100+ categories and over 1800 brands.

They have recently launched Finder Earn, a feature of their app that lets you earn interest on TAUD – a stablecoin that is pegged to the Australian dollar.

Mining vs Staking

The two most common methods of validating transactions on a blockchain network are mining and staking. Mining is conducted on blockchains that use a Proof of Work consensus algorithm, where as staking is the validation method used by Proof of Stake algorithm.

Mining (Proof of Work)

Blockchain or crypto mining refers to computers competing against each to solve complex mathematical equations in order to verify transactions on a network. This is key in Proof of Work (PoW) consensus mechanisms which was pioneered by Bitcoin and later adopted by other large blockchains like Ethereum, Litecoin and Dogecoin. The issue with this is that it requires large amounts of energy, which can be damaging for the environment. Proof of Stake aims to resolve this issue.

Staking (Proof of Stake)

Proof of Stake (PoS) is an alternative method of validation that is quickly replacing Proof of Work. Ethereum is currently in the process of transitioning from PoW to PoS in order to improve the scalability of the network and to reduce its environmental impact.

Instead of using computational power, PoS systems select a user to validate transactions and create new blocks. In order to be selected, users must stake a certain amount of coins.

Is staking crypto worth it?

Staking crypto can be an effective way to earn passive income on your crypto holdings. Rather than letting your crypto sit in your wallet and collecting dust, you can send it to work and and allow it to make you money while you sleep. Depending on the coin you stake, you can earn up to 80% APY which is far greater than any interest offered by banks.

If you are considering buying a cryptocurrency just so you can stake it, it’s important that you conduct thorough research into the coin. After all, if a coin is earning 101% APY but it loses its value over time, the rewards from staking will not be enough to cover the loss in your investment.

However, if you have conducted research into a cryptocurrency and believe in its underlying technology, then staking is an added benefit on top.

Is crypto staking safe?

Cryptocurrency staking is safe. The inherent risk from staking comes from the volatility of cryptocurrency. Crypto is a volatile asset class so if the price of the coin your staking decreases, the interest earned through staking might not be enough to cover your overall loss in value.

Additionally, some staking and earn services, require you to sign a loan contract. When entering into any loan agreement, there is a risk that the company may not be able to repay their customers if they become insolvent.

How can I stake my crypto?

Staking your crypto can differ from platform to platform. The process, however, is usually quite simple, particularly on beginner exchanges like Coinspot. Simply sign up and purchase crypto through the app. Then navigate to the Staking/Earn tab and choose which cryptocurrency you’d like to stake. From there, simply select how much you’d like to stake and confirm your order.

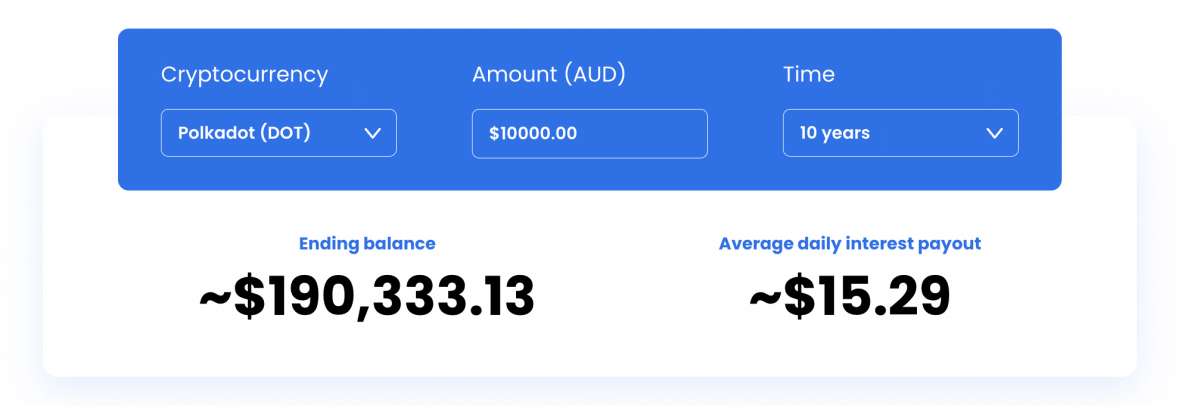

Is staking crypto profitable?

Staking crypto can be very profitable especially if done long term and the crypto asset you’re staking retains its value. Also, with staking you can unleash the power of compound interest. With some crypto staking platforms, your interest compounds daily. For instance, if you stake $10,000 Polkadot (DOT) over 10 years which has an APY of 12%, you’re ending balance will be approximately $189,000.

Note: This figure are based on the price of Polkadot remaining the same over 10 years.

Staking through a wallet vs staking through an exchange

The key difference between staking through a crypto wallet compared to an exchange is having ownership of your private keys. One of the most common sayings is ‘not your keys, not your crypto.’ This essentially means, that if you hold your crypto on an exchange, you are not in control of it. You may trust your crypto exchange, however, if it becomes insolvent, they may not be able to repay your crypto that you are either holding or staking within its platform.

Another benefit of staking through a wallet is the available options. Most exchanges (aside from Binance) will only have a limited number of eligible coins to stake. Depending on the wallet you stake through, you may be able to stake low-cap altcoins that are not available on all exchanges. The most common way to stake crypto through a wallet is by connecting it through a decentralised finance (DeFi) protocol. DeFi staking can sometimes offer higher APYs than those found on exchanges.

Do I need to pay taxes on staking?

Yes, crypto staking is subject to tax in Australia. Unlike profit made from buying and selling crypto, any rewards you receive from staking will not trigger a capital gains event (CGT). Instead, they are treated as regular income by the Australian Tax Office (ATO).

As crypto staking rewards are paid out in cryptocurrency rather than cash, you must determine the market value of the asset when you receive it. The income from staking rewards will then be added to your other income and will be taxed in accordance with your tax bracket.

For example, let’s say you stake 1000 Cardano (ADA) which is equivalent to $1000 AUD and earn 60 additional ADA after one year. You look up the market value of 40 ADA which is equal to $60. The additional $60 that you have made staking ADA is now considered ordinary income for tax purposes.

For more information on staking tax and cryptocurrency in general, visit this guide.

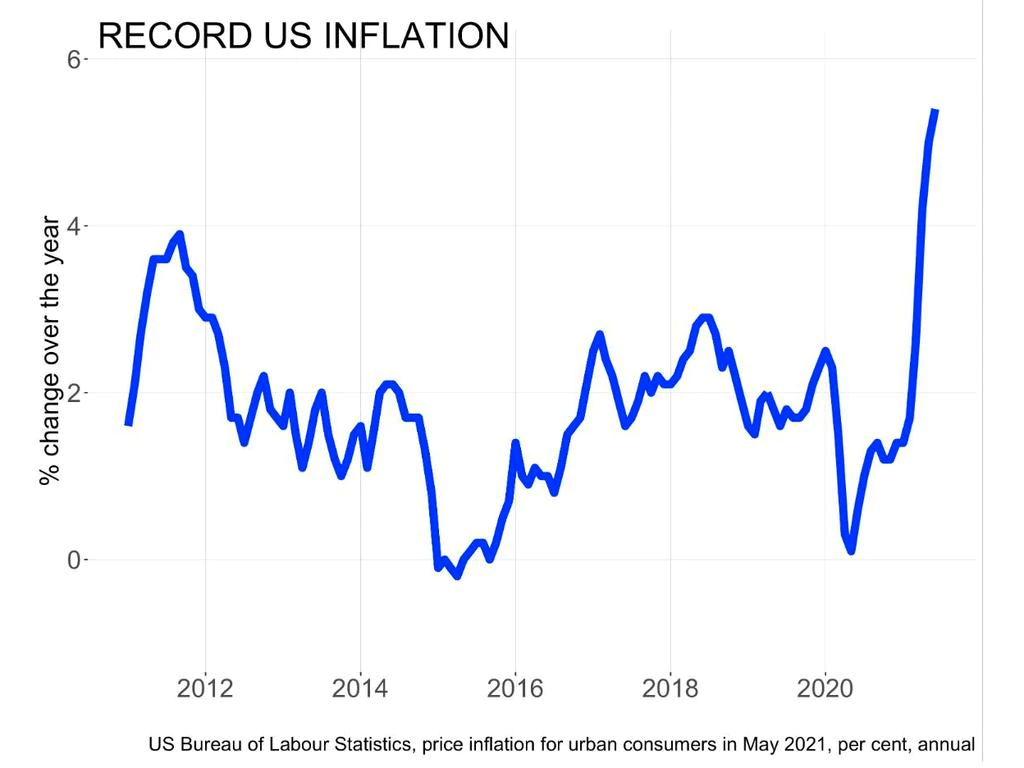

Use Stablecoins to Hedge Against Price Inflation

Stablecoin yield has become quite popular in recent years as it can be used as a hedge against inflation. Inflation across the world has risen significantly in 2022 & 23. The inflation rate in Australia is at a 20-year high. Across the Pacific, in the United States, it’s at a 40-year high.

Staking cryptocurrency can be an effective way to earn passive income, however, you’re exposing yourself to the volatility of the crypto market. Stablecoins are designed to be non-volatile as they are pegged to fiat currencies like AUD and USD. Though these currencies can still fluctuate in value, they are not nearly as volatile as cryptocurrencies.

The interest offered on stablecoins is typically much high than the interest you can earn through a bank savings account. Often, the interest available from through a savings account is lower than the rate of inflation meaning you’re actually losing money in the long term.

APY vs APR

Annual Percentage Yield (APY) and Annual Percentage Rate (APR) are both terms used to calculate interest on staking and other earning products. Though they’re similar, these terms mean two different things and it’s important to know the difference when choosing the best platform to stake crypto.

The key difference between APY and APR is that APY takes compound interest into account. It is the actual rate of return that you will earn from staking crypto and is a method for calculating the amount of money you can earn from staking digital assets over a year.

For this reason, the APY is larger than the APR.

Flexible vs locked staking

Crypto exchanges like Binance and Crypto.com offer both flexible and locked staking. Flexible staking allows you to withdraw your unstake your crypto at any stage. Locked staking, on the other hand, means you must commit your crypto to staking for a specific period of time. Typically, this works in increments of 30 days (i.e. (30, 60, 90, 120 days). If you chose to withdraw your crypto before the locked term ends, then it is likely you will not receive any of the rewards you earned while staking.