If you’re wondering whether stocks or cryptocurrency are the better investment choice, we’ve got you covered. In this article, we’ll outline the key differences between crypto and stocks, and the pros and cons of each investment type.

What are cryptocurrencies?

Cryptocurrencies are digital coins or virtual tokens, that can be purchased on a cryptocurrency exchange. Crypto uses cryptography and blockchain technology to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they’re not subject to government or financial institution control.

Bitcoin, which was created in 2009, was the first cryptocurrency. It is also the most well-known. Since Bitcoin’s inception, thousands of other digital currencies have been created. These are often referred to as altcoins, which stands for “alternative coins”.

Cryptocurrencies are often associated with a specific project or company. For example, Ether (ETH) is a cryptocurrency that is used to fuel the Ethereum network and its corresponding applications. Other examples of cryptocurrency include Litecoin, Bitcoin Cash, and Monero.

Learn how to buy cryptocurrency in a few easy steps.

What are stocks?

A stock is a type of security that indicates ownership in a corporation and represents a claim on part of the corporation’s assets and earnings. When you buy stock, you become a shareholder. Publicly traded companies have their stocks listed on stock exchanges, such as the Australian Stock Exchange (ASX), where they are bought and sold by investors.

The value of a company’s stock is determined by the number of shares outstanding multiplied by the current share price.

There are two main types of stocks: common stock and preferred stock.

Common stock is what most people think of when they think of stocks. It entitles the holder to vote on corporate matters, share in the corporation’s profits or losses, and receive dividends if the company declares them. Common stock can be further divided into additional asset classes including; growth stocks, value stocks and income stocks.

Preferred stock doesn’t offer voting rights but does have priority over common stock when it comes to dividends and assets in the event of liquidation.

Related: Crypto staking vs stock dividends.

Pros of investing in cryptocurrencies

There are several benefits of investing in cryptocurrency. In recent years we’ve seen this become an increasingly popular investment choice in Australia.

Interesting fact

A staggering 18.4% of Australians own cryptocurrency, with the leading driver being portfolio diversification.

Accessibility

Crypto is incredibly accessible and can be bought from anywhere in the world at any time of day. All you need is an internet connection and a crypto wallet.

There are numerous cryptocurrency exchanges in Australia alone, such as Swyftx, that make the process of buying crypto easy and straightforward.

Liquidity

Cryptocurrencies are also incredibly liquid, meaning they can be easily converted into cash. This is in contrast to assets such as property or fine art, which can take months or even years to sell.

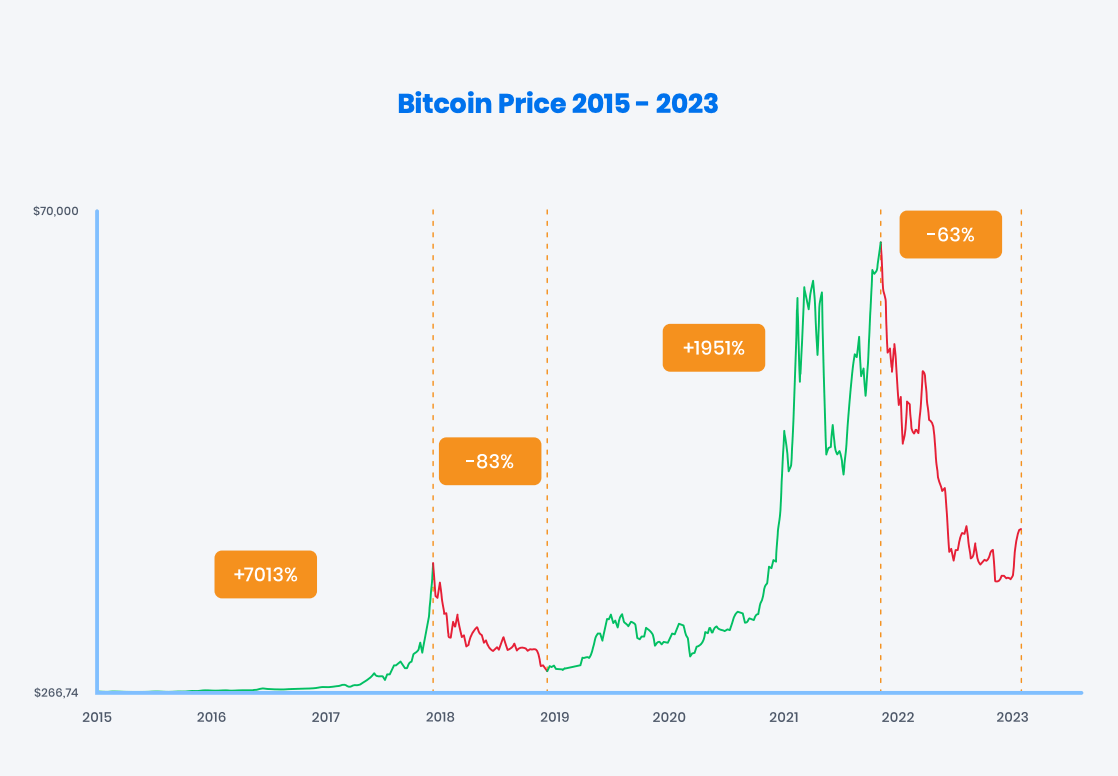

Large gains

Investors in crypto have the potential to see very high returns on their investments. For example, Bitcoin was around 10 US cents in 2009. Compare that with its all-time high in 2021 of $68,789 USD. That’s a staggering 68 million percent increase in just over 10 years!

Important to remember

Crypto is a volatile asset, and investments can go up or down. The same volatility that can cause large gains can also cause large losses. Like stocks, nothing is ever guaranteed.

Diverse range of coins

The crypto market is full of a diverse range of coins, each with its own purpose and use case. This means that there’s a crypto coin out there for everyone, and likely a crypto project you may want to get behind.

For example, Ether is used to fuel the Ethereum network and its corresponding applications. This makes it different from Bitcoin, which is primarily used as a digital currency or store of value.

Cryptocurrency projects and their associated coins typically exist to solve real-world problems.

Decentralized

Cryptocurrency is also appealing because it’s not subject to government or financial institution control. This means that crypto isn’t subject to inflationary pressures like fiat currency is.

Pros of investing in stocks

Stocks have been a popular investment for centuries and there are several reasons why.

Dividends

One of the main benefits of stocks is that they offer the potential for income in the form of dividends. Dividends are a portion of a company’s profits that are paid out to shareholders.

Not all companies pay dividends, but for those that do, it can provide a valuable stream of income, particularly for retirees.

Growth potential

Another benefit of stocks is their growth potential. When a company does well, its stock price will usually go up. This means that investors can build wealth from both the dividends and the capital gains on their shares.

This can provide a great deal of financial security and peace of mind, knowing that your investment is growing over time.

Proven long-term investment

Stocks are a proven long-term investment. Over the past century, stocks have consistently outperformed other asset classes, such as bonds and gold.

This is especially true when you consider that dividends are reinvested back into the stock, providing even more growth potential. Because of compound interest, stocks have the potential to make a significant amount of money over time.

Highly regulated

Stocks are also a highly regulated investment, which adds an extra layer of security. Companies must meet strict financial and legal requirements in order to be listed on a stock exchange.

This means that investors can be confident that they’re buying into a legitimate business with a long-term future.

Less volatile than crypto

While considered more volatile than bonds or gold, stocks are much less volatile than crypto. This is because stocks are more established and have a longer history. As a result, stocks are generally considered to be a “safer” investment than crypto, especially for those who are risk-averse.

Cons of investing in cryptocurrencies

Cryptocurrency is not without its downsides. Here are some of the cons of investing in crypto.

Extreme volatility

The biggest downside of crypto is that it is extremely volatile. The prices of crypto can swing up and down a great deal in a short period of time.

One such example is the infamous Crypto Crash of 2018, which saw Bitcoin drop nearly 80% in one month. It’s since rallied and hit unprecedented highs, but this is just one extreme example of the volatility of digital assets.

Cybersecurity risks

The security around crypto exchanges is the best it has ever been, but like anything, the security is still not airtight.

Cryptocurrency is also a target for hackers and cybercriminals. Because crypto is stored online, it’s at risk of being stolen by someone who knows how to hack into a crypto exchange or digital wallet.

Scams in cryptocurrency are also not uncommon and have duped many investors out of their hard-earned money.

In order to protect yourself from these risks, do your research and know the warning signs of a potential cryptocurrency scam.

Regulatory risks

Another downside of crypto is regulatory risk. Cryptocurrency is still not widely accepted or regulated by governments. This means that it’s subject to sudden changes in regulation that could have a negative impact on crypto’s future value.

For example, in September 2017, China unexpectedly banned Initial Coin Offerings (ICOs), which sent the crypto market into a tailspin. The market has since recovered, but this was a reminder of the regulatory risk associated with digital currency.

Tax

Perhaps the biggest con when it comes to cryptocurrency and taxation is not being familiar with your tax obligations and winding up with a nasty shock from the tax office

For instance, In Australia, cryptocurrency is subject to capital gains tax upon disposal, and income tax under certain circumstances.

Cons of investing in stocks

There are also downsides to investing in stocks. We’ve listed a few below.

High fees

One downside of stocks is that there can be high fees associated with trading and managing a portfolio.

This is especially true if you use a traditional broker. These fees can eat into your profits and reduce your overall return on investment.

Still a volatile market

While their volatility may not be quite as extreme as cryptocurrency, stock markets still experience market swings. This means that your investments can go up or down in value and you could lose money.

They’re especially subject to fluctuations based on news and global events. For example, the outbreak of COVID-19 in 2020 led to a stock market crash as investors panicked about the economic impact of the pandemic.

Less potential for extreme gains

Cryptocurrency can experience massive gains in a short period of time. Whereas stock trading can still perform incredibly well, such dramatic increases are less common.

This means that if you’re looking for the potential to make a quick profit, crypto may be a better option than stocks.

Can only be purchased at certain times

Stocks can only be bought and sold during trading hours on the stock market. This means that if you want to buy or sell stocks, you need to do so during these times.

Tax

Tax obligations when it comes to stocks apply to both capital gains and dividends. This can make tax time a little more complicated for investors with a portfolio of stocks.

Asset diversification

Many experts believe that the best investment strategy is to invest in both crypto and stocks. This can help you build a diversified portfolio and reduce your overall risk. This is because if one asset class falls in value, the other may rise, offsetting some of the losses.

Investing in both crypto assets and stocks can also help you to take advantage of different opportunities. For example, if you think crypto is due for a bull run, you can invest more heavily in digital currency. Alternatively, if you believe that a particular stock is undervalued, you can increase your investment in that company.

Furthermore, if you want a middle ground, you could choose to invest in a Bitcoin or crypto ETF, which allows you to speculate on the prices of Bitcoin and other cryptocurrencies through a fund accessible on the stock market.

Tip

Crypto and stocks often perform differently at different times. For example, in 2020 crypto prices surged while the stock market crashed due to the COVID-19 pandemic. This showed that crypto and stocks can react differently to global events.

Key takeaways

Cryptocurrency

| Pros | Cons |

| Can be traded 24 hours a day, seven days a week | Susceptible to rapid fluctuations in price |

| Decentralized and don’t require third parties intermediaries | Not as regulated as other financial markets |

| Can be bought and sold anywhere in the world | Still emerging and can sometimes be subject to hacks |

Stocks

| Pros | Cons |

| More stable than the crypto market | Can only be bought and sold during trading hours on the stock market |

| Potential for income in the form of dividends | Broker fees can be very high, especially when trading international stocks |

| Proven long-term investment, which have consistently outperformed other asset classes | Huge stock market crashes are not uncommon |

Summary

Cryptocurrency is a digital or virtual asset that uses cryptography to secure its transactions. Stocks are shares of ownership in a company that are issued on a stock exchange. Depending on your risk tolerance, it’s likely a good idea to have a diversified investment portfolio that includes both crypto and stocks in order to mitigate your investment risk.

Do your research and if in doubt, contact a professional financial adviser

Other handy resources: