How to buy Ethereum (ETH) in Australia

- Register an account with an Australian crypto exchange

- Complete account verification

- Enable Two-Factor Authentication (2FA)

- Deposit funds (AUD) into your account

- Buy Ethereum

With Ethereum hitting new all-time highs in 2021 and transitioning to a more eco friendly model in 2022, many eager investors have looked to add the world’s second-largest cryptocurrency to their portfolio. Ethereum is a blockchain platform that has revolutionised the cryptocurrency industry. The platform features its own digital currency, ETH, which you can purchase via a number of platforms.

Contrary to popular belief, investing in cryptocurrency is very quick and simple. In this guide, we’ll breakdown where to buy and how to buy Ethereum in Australia.

Where is the best place to buy Ethereum?

The most secure and popular way to purchase ETH – or any digital currency – is through a crypto exchange. There are many exchanges in Australia – the most important thing is for you to choose one that is reputable and meets your needs.

Other considerations when choosing an Australian exchange may include what coins they offer and their trading fees. Read our comprehensive guide to the best Australian crypto exchanges.

Coinware considers the below 3 exchanges to be the best options for buying Ethereum in Australia.

How to buy Ethereum in Australia

For detailing the steps on how to buy ETH in Australia, we will use the Swyftx cryptocurrency exchange as an example. We consider Swyftx to be the best exchange for buying cryptocurrency in Australia due to its easy to use platform and app, great customer service and affordable fee structure.

Although we are using Swyftx as an example of how to invest in Ethereum, most platforms will have similar buying procedures. So, if you are not planning on signing up to Swyftx, this guide will still be very useful for you.

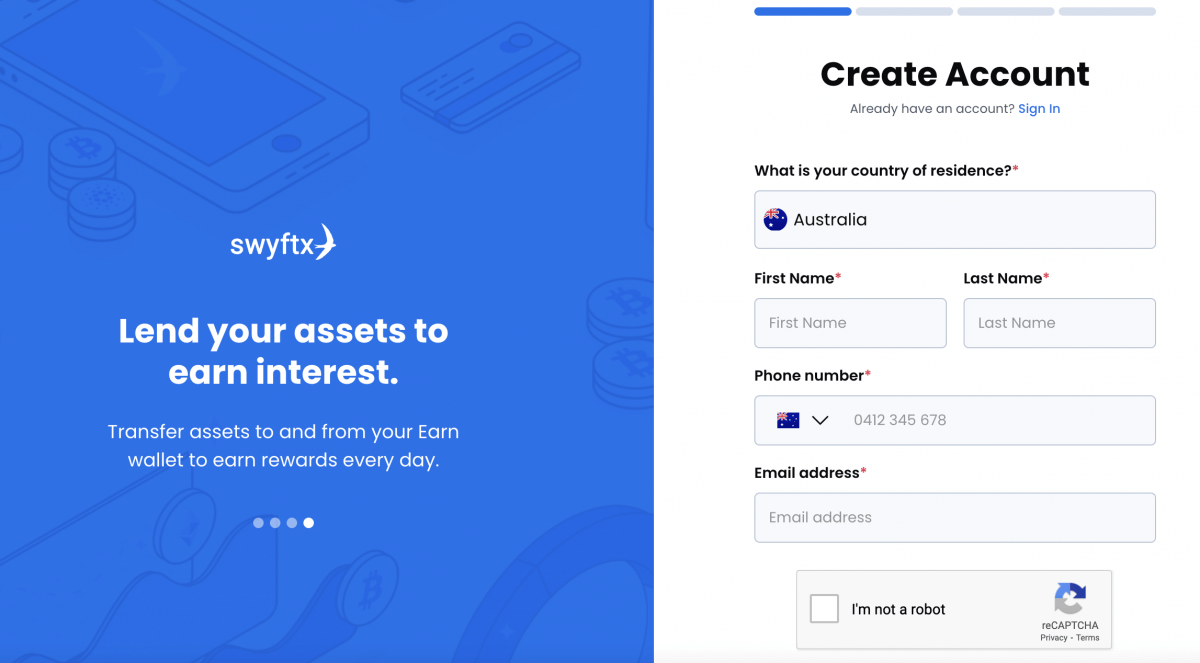

Step 1: Register an account

You can register for your Swyftx account here. Before you arrive at your Swyftx dashboard, you’ll be asked to fill out a simple questionnaire. Here you’ll need to provide a few simple details like name, email address and phone number, You’ll also need to create a secure password. We cannot stress enough the importance of making this password unique. It should not be the same password that you use for your email address or social media accounts.

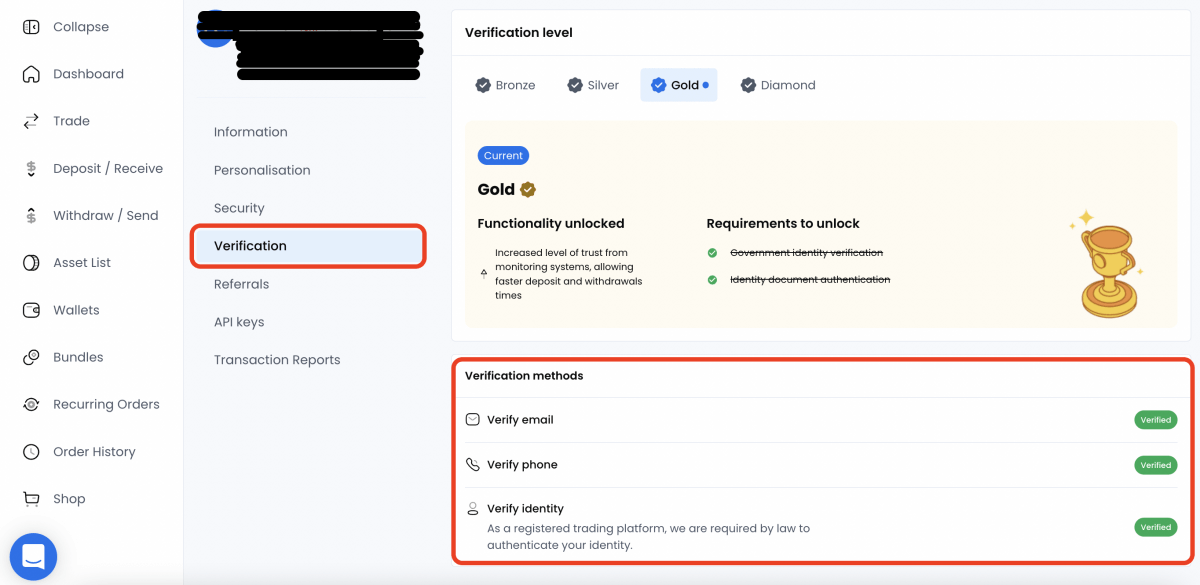

Step 2: Comple KYC verification

To be able to deposit fiat currency or acquire cryptocurrency, you must first verify your account.

From the left-hand menu, select Profile > Verification to begin the process of validating your account. Government-issued identification, such as a Driver’s License or Passport, will be needed to verify your identity. This is crucial for a few reasons, not only because Swyftx connects to your Australian bank account, but because any gains or losses you make on your digital assets are also subject to Capital Gains Tax.

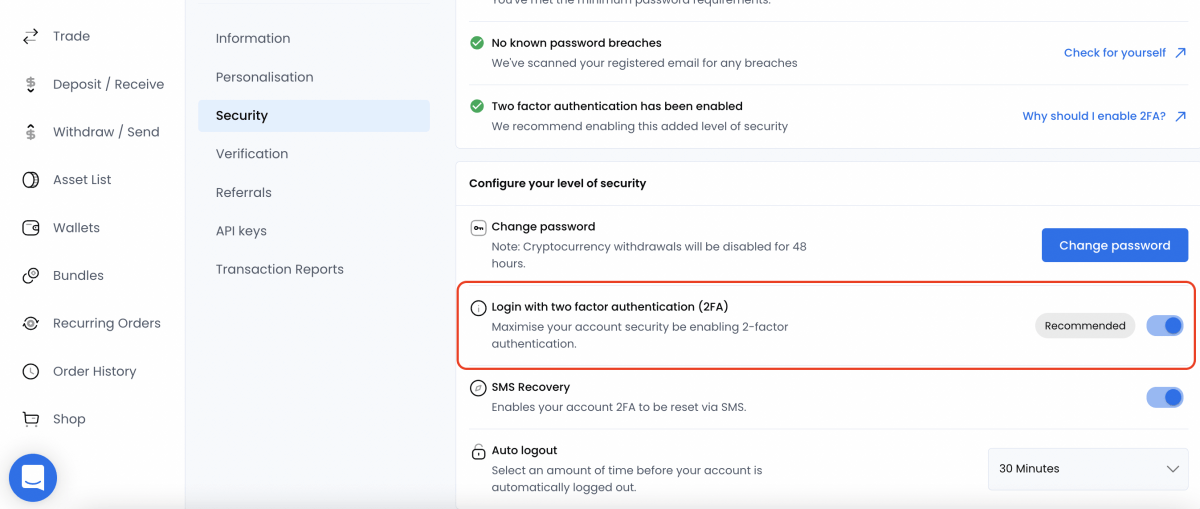

Step 3: Enable Two-Factor Authentication (2FA)

It’s very important to secure your account and your crypto assets with Two-Factor Authentication (2FA). This adds an extra layer of security on top of your account. After setting it up, you’ll be required to put in a time-sensitive code when logging into your account or withdrawing funds. The idea is that if someone is able to get access to your password, they will not be able to enter your account as the code will only be accessible on a device available to you (i.e. your mobile phone).

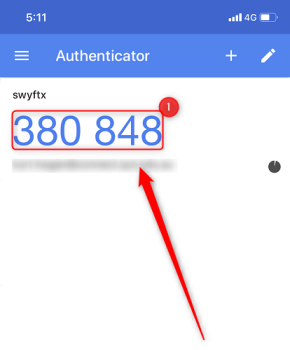

Most exchanges support 2FA apps such as Google Authenticator and Microsoft Authenticator. Simply create an account with one of these apps and then under then in your Swyftx account simply follow Profile > Security > Two Factor Authentication and follow the prompts.

We use Google Authenticator as our 2FA. You can download the Google Authenticator app and then paste in the code provided to you by Swyftx. This should connect the two accounts. Once these are connected you’ll need this time sensitive code provided by your authenticator app everytime you login into your account.

Step 4: Deposits funds (AUD) into your account

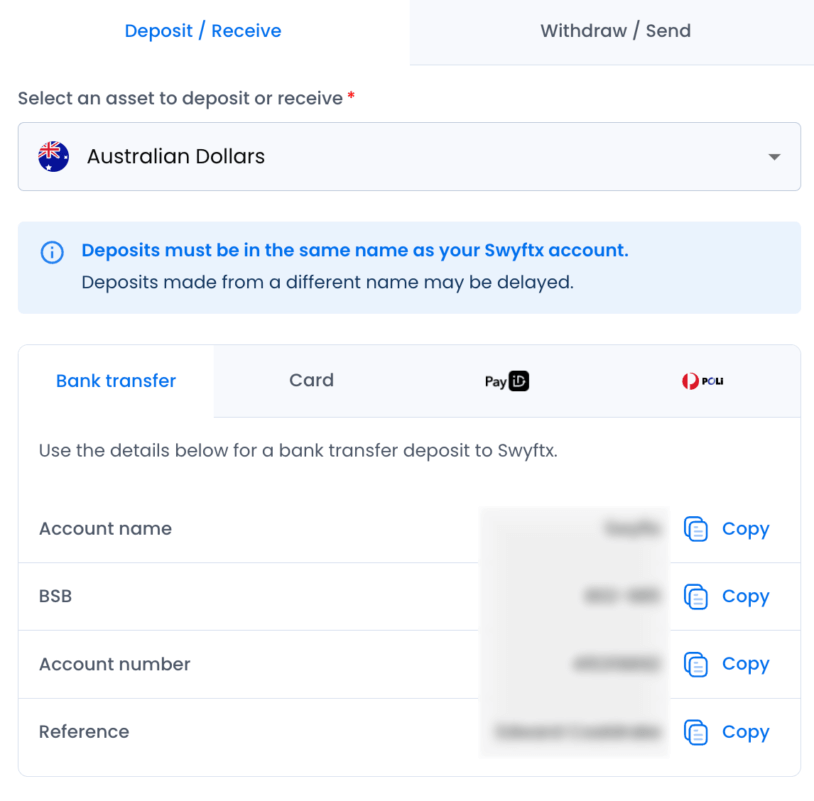

You’ll need to have a funds balance before you can buy Ethereum. In the left-hand menu, go to Deposit. There is a multitude of methods to deposit currency, including bank transfer which, for OSKO-enabled banks, is instant. There are no fees charged when you deposit via bank transfer on Swyftx.

If you’d prefer a different payment method you can also use PayID, POLi or debit or credit card. When transferring money from your bank account to your Swyftx account, make sure you put in all the details correctly.

If you already hold cryptocurrency in a digital wallet, it is also possible to deposit your crypto assets directly into Swyftx using your Swyftx wallet address.

Step 5: Buy Ethereum

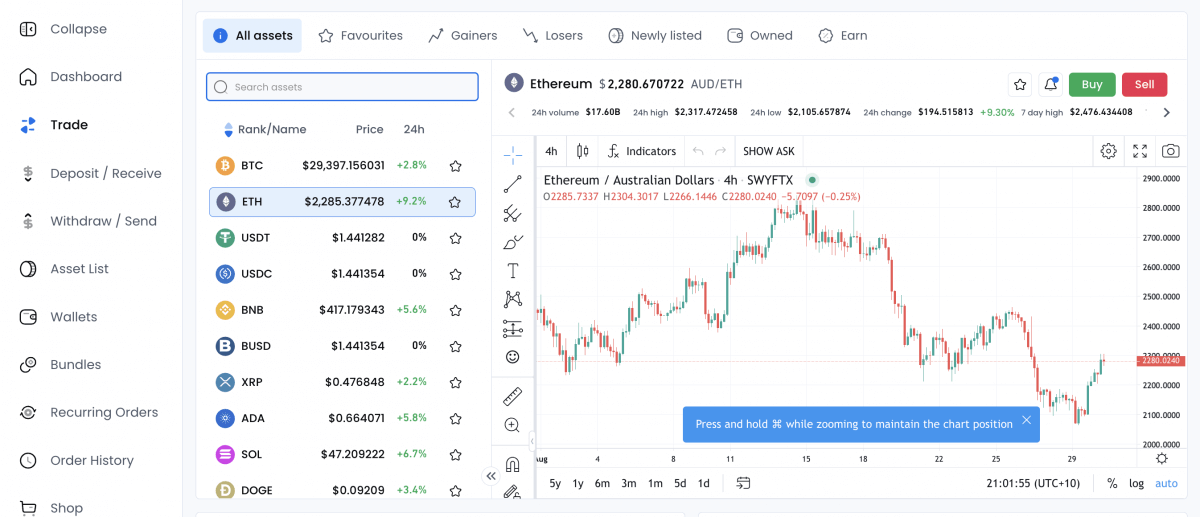

Now that your account has been funded with Australian dollars (AUD), you can now purchase Ethereum quickly and easily.

Navigating the left-hand menu, follow the following trail: Dashboard > Trade > search for Ethereum > Buy

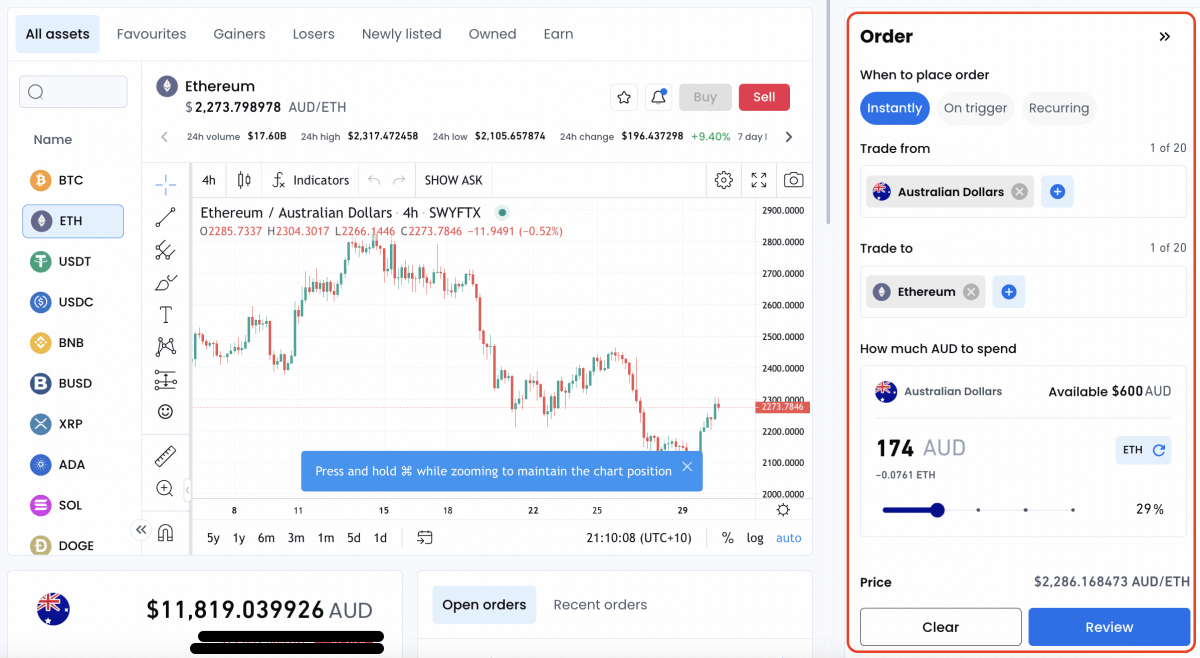

A window will pop up on the right hand side of the screen. Here is where you can select which type of order you’d like to execute and how much ETH you’d like to buy.

In the box that is labelled ‘How much AUD to Spend’ Select how much AUD you wish to spend on investing in Ethereum. Alternatively, you can select how many ETH you wish to buy. It’s important to note that you can buy a fraction of 1 ETH.

Review your order details and once you’re happy click ‘Place Order.’

What is Ethereum?

ETH is the native cryptocurrency of the Ethereum blockchain platform. Ethereum is used to host decentralised applications (dApps) and execute peer-to-peer smart contracts. The network is decentralised and open-source meaning developers can deploy their own dApps without any downtime or control from a third party.

Launched in 2015, Ethereum has garnered a lot of adoption and mainstream attention, making it an attractive investment option for many. It’s native token, ETH, is used to pay for transactions on the network. Ethereum currently stands as the second biggest cryptocurrency by market capitalisation, trailing only to Bitcoin (BTC).

Read our beginners guide to Ethereum.

What gives Ethereum value?

Ethereum’s value is derived from its deflationary supply, adoption and use, and innovation. With a limited supply of 18 million coins per year, Ethereum’s deflationary supply model can drive up its value. Additionally, Ethereum has gained widespread adoption among businesses, developers, and individuals due to its ability to support decentralised applications and smart contracts. The innovation behind Ethereum’s technological capabilities, such as the introduction of smart contracts, has enabled the creation of new business models and further enhanced its value. As more people and businesses continue to adopt Ethereum and new applications are developed, the demand for Ether is likely to continue to increase, which can further increase its value.

Is Ethereum a good investment?

Whether or not Ethereum (ETH) is a good investment depends on several factors, including your personal financial goals, risk tolerance, and investment strategy.

Ethereum’s potential for growth and ability to support decentralised applications have led to its widespread adoption in the cryptocurrency market. However, like any investment, it carries risks due to the highly volatile nature of the cryptocurrency market and the developing regulatory environment. Before investing in Ethereum, it’s important to do your research, consider your investment strategy, and seek professional financial advice. Only invest what you can afford to lose.

Choosing a secure exchange

There are several reputable platforms through which to purchase ETH, and there are plenty of dubious ones.

When it comes to selecting an exchange, there are several things you should consider, including online reviews, the level of security they employ, their reputation, how much trading fees are, and how user-friendly their website is.

It’s also worth noting that, because cryptocurrencies are decentralised, they are not under the control of any government or central authority. As a result, it may be difficult to determine who is in charge or what regulations apply to various operations.

One such regulation you should be aware of is that cryptocurrency exchanges in Australia should be AUSTRAC registered. They have a customer due diligence program in place, which means they have an AML/CTF program (Anti-Money Laundering and Counter-Terrorism Financing) in place.

Where to store your Ethereum

Cryptocurrencies like Ethereum is stored in digital wallets. Crypto exchanges like Swyftx have wallets built into their platform, allowing for convenient storage of ETH, however most experts recommend that you store the majority of your crypto portfolio in self custody wallets, whereby you have ownership of the wallet keys.

There are two types self custody wallets: cold and hot. Cold storage is offline and includes hardware and paper wallets, which offer high security but carry risks like loss or damage. Hot storage wallets are online, including mobile, desktop, and browser extension wallets. These offer convenience for trading, but are more prone to hacks and scams than cold storage. It’s important to be cautious and choose the best option for your needs.

What to consider before buying Ethereum

Move to Proof of Stake (PoS)

Ethereum started and still uses a Proof of Work consensus algorithm, which is famously used by Bitcoin. However, Ethereum developers have announced that it plans to move to Proof of Stake, which will improve the scalability of the network. In what is called Ethereum 2.0, Proof of Stake will change the way the ETH transactions are verified. To put it simply, transactions are expected to be a lot cheaper and quicker, something that the Ethereum network has struggled with in the past.

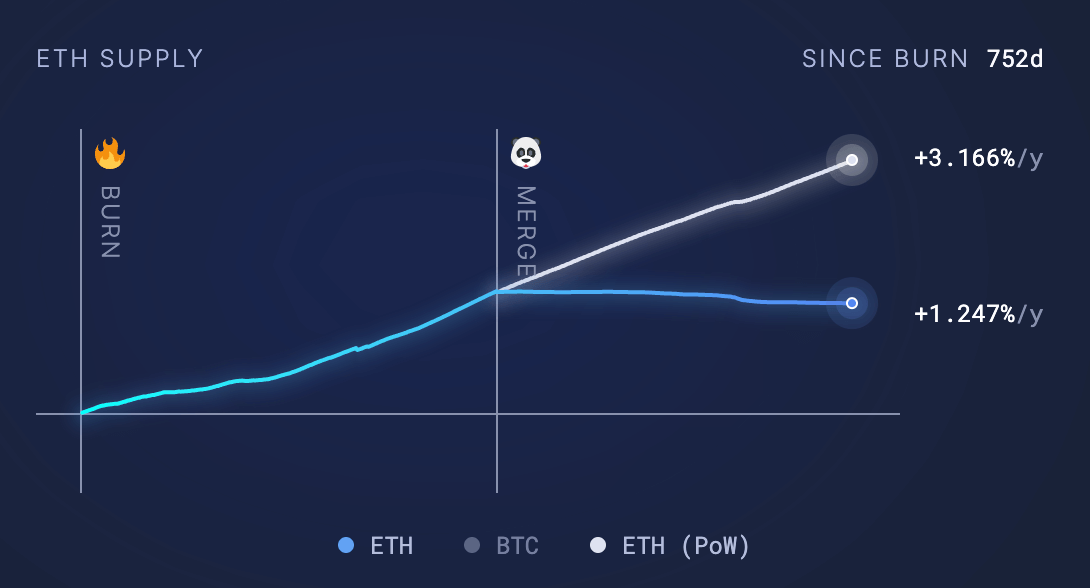

The move from Proof of Work to Proof of Stake has made ETH a deflationary asset. The image below shows that the supply of ETH has slightly decreased since the Merge compared to if Ethereum continued using Proof of Work.

Additionally Ethereum’s recent Shanghai upgrade allowed people to access their staked ETH which had been locked up for 2 years. Some people speculated this would lead to a sell off but it actually led to more ETH being staked. with other upgrades like the sharding upgrade which seeks to further scale the Ethereum network, this puts Ethereum in good stead for the future.

Competitors

Though Ethereum is a market leader, there are a number of other smart contract platforms that have been on the rise in the last few years. Ethereum’s biggest competitors include Solana, Cardano and Polkadot. It’s important to analyse these competitors before investing in Ethereum to see if they could potentially be a competitive threat to the network in years to come.

Adoption

Ethereums adoption, both in the crypto industry and in the real world, is a good indicator of its value. The Ethereum ecosystem is already well established, with dozens of decentralised applications already running on its platform. However, it’s important to research how Ethereum is being adopted by institutions and individuals outside of the blockchain industry.

Additionally